SPDR S&P 500 ETF (SPY)

Key Statistics

Thank you for reading this post, don't forget to subscribe!

Minor Support Level 293.22 Minor Resistance Level 352.71

Major Support Level 155.73 Major Resistance Level 377.92

Minor Buy Signal 358.75 Minor Sell Signal 286.33

Major Buy Signal 389.77 Major Sell Signal 139.54

BRIEF OVERVIEW

Risk-on risk-off is an indicator used for measuring investors’ appetite for speculative investments. Generally speaking, investors have a tendency to move in the same direction, particularly on a short-term basis. This explains why financial markets have a history of generating dramatic intra-day price movements across all asset classes.

Risk-on risk-off is driven by investor psychology along with emotional responses to financial reports, macro-economic events, geopolitical announcements and unexpected changes to the global investment landscape. It’s not uncommon for investors to be locked in the same risk environment for several months in a row. Suddenly, usually without warning, an unexpected economic event or major financial report will cause investors to change their tolerance for risk. This “herd mentality” will usually produce a substantial movement in the global financial markets.

In terms of specific investments, which are considered risk-on and which are considered risk-off? Please review the following list:

Risk-On Assets

- Stocks

- Commodities

- Real Estate

- Precious Metals

- Cryptocurrencies

- Alternative Assets

Risk-Off Assets

- Government Bonds

- Cash

- US Dollar

It’s not surprising that risk-on assets include highly speculative investments like stocks, commodities and cryptocurrencies. Risk-off assets include safe-haven investments like bonds, cash and US Dollar. Cash is comprised of several different short-term investments like money market accounts, bank savings accounts, Treasury Bills, money market mutual funds and any type of liquid investment with a maturity date of less than one year. In the the crypto universe, stable coins are viewed as cash.

Several months prior to the start of the global pandemic in February 2020, investors were leaning heavily in favor of holding risk-on assets. In fact, an argument could be made that a risk-on bull market had been in effect since late-2016.

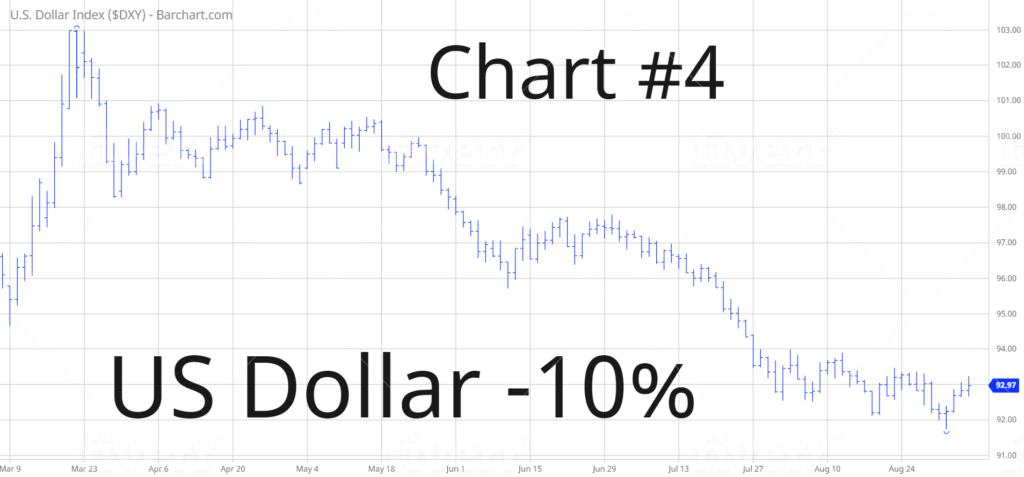

Beginning in February, investors immediately abandoned their risk-on assets when it became abundantly clear that our planet was on the verge of a worldwide pandemic. Almost overnight, global investors switched from risk-on to risk-off. Global equity markets plummeted, commodities collapsed, precious metals took a tumble and crypto prices experienced a sharp decline. Suddenly, risk-off assets found themselves in a roaring bull market. Bond prices skyrocketed to the upside, the US Dollar soared to a multi-year high and investors were piling into cash.

The vast majority of the investment universe was convinced that the coronavirus would force risk-on assets to remain in a bear market for the next several months or longer. However, thanks to massive central bank money printing, the risk-off bull market lasted a grand total of approximately six weeks. Investors soon realized that world leaders would stabilize the global economy with unprecedented levels of monetary and fiscal stimulus. Therefore, the global investment community quickly liquidated their risk-off assets in exchange for stocks, commodities, precious metals and crypto.

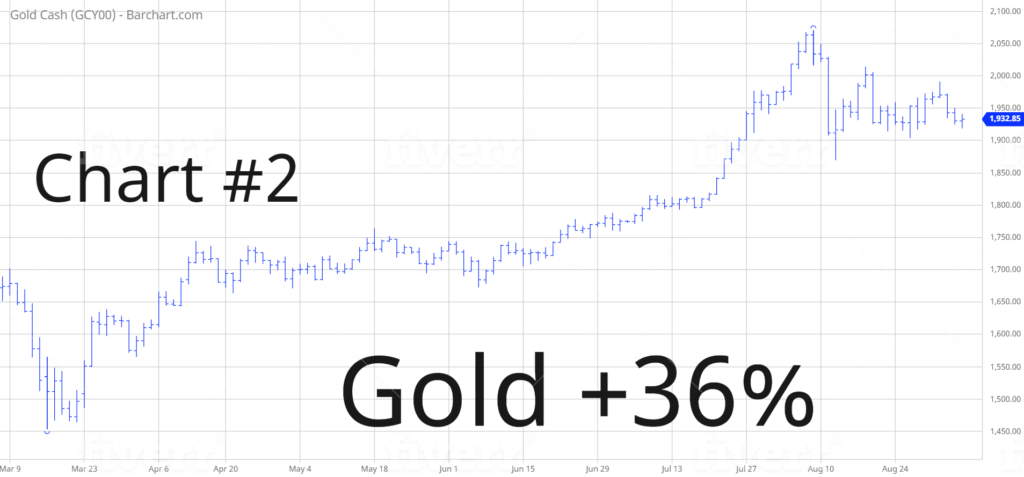

During the past five months, risk-on assets have enjoyed an incredible bull market. For example, global equities (as measured by Vanguard Total World Stock Index ETF) have risen 56%, gold has advanced 35% and Bitcoin has exploded by 154%. Risk-off assets like the US Dollar have experienced substantial declines during the same period. Investors are abandoning the safety of the US Dollar in favor of risk-on assets. Please review the attached charts

(Chart #1 thru Chart #4).

Despite the recent dramatic rally, risk-on assets are in the early stages of a long-term bull market. Why? Because global central banks and government leaders have no intentions of reducing or eliminating money printing programs or fiscal stimulus programs. In fact, several governments and monetary authorities have plans to increase their stimulus programs. The risk-on bull market is just getting started, which should be quite bullish for stocks, commodities and digital assets.

In an effort to provide investors with exposure to the S&P 500, the SPDR family of exchange traded funds introduced the S&P 500 ETF on 22 January 1993. The ticker symbol is SPY. The ETF allows investors to participate in the S&P 500 without the burden of owning shares of each company within the index. SPY is historically significant because it was the very first exchange traded fund listed in the United States. SPY is easily the most heavily traded ETF, with daily volume usually exceeding 100 million shares.

SHORT-TERM VIEW

Despite the sharp decline near the end of the week, the bulls remain in control of the short-term momentum. The next level of resistance is 352.71. The bears need a weekly close below 293.22 in order to recapture the momentum.

LONG-TERM VIEW

Cash Is Trash – During the past few months, several of the most successful investors on Wall Street have publicly advocated for moving out of cash in favor of risk-on assets. Global central banks have made it perfectly clear that they will continue to devalue paper money by printing excessive amounts of fiat currency units. Additionally, the vast majority of G20 monetary leaders have pushed interest rates to 0%. In fact, some countries are below 0%. Of course, this means that savers are watching their account balances slowly erode over time.

To make matters worse, the Federal Reserve recently announced that it would allow the level of US inflation to rise above its target rate of 2%. There has never been a time in the 100+ year history of the Federal Reserve where Fed leaders have completely abandoned their policy objective of maintaining price stability. Essentially, monetary authorities (lead by the actions of the Federal Reserve) will do “whatever it takes” to create inflation in an effort to resurrect the global economy.

Based on central bank policy decisions, it is becoming crystal clear that monetary authorities are discouraging investors and savers from holding cash balances. Instead, they want investors to stimulate the global economy by investing in stocks, commodities, real estate, digital assets, precious metals and other alternative assets. History has repeatedly shown us that it’s never a good idea to ignore central banks in regard to their policy objectives. This explains why “cash is trash.”

In regard to SPY, the long-term momentum is bullish despite the brutal decline in February and March. The next resistance level is 377.92. The bears had an opportunity to recapture the momentum in March. However, they never were able to penetrate the major support level @ 155.73. The most likely scenario is a continuation of higher prices.

SHORT-TERM CHART – SPY

Please review the 6-month chart of SPY (Chart #5). The ETF suffered a nasty decline during the final two days of the week. Despite the decline, the bulls remain in control of the short-term chart pattern. The next level of resistance is 352.71. The bears need a weekly close below 293.22 in order to flip the chart pattern into bearish territory.

LONG-TERM CHART

Please review the 15-year chart of SPY (Chart #6). With the exception of Q1 2009, the long-term (secular) chart pattern has remained bullish for 15 consecutive years. The likelihood of a secular bear market appears rather remote. The major support level is 155.73.

Publisher’s Note

In response to the dramatic rally in SPY, the major support level and major sell signal have been adjusted.