ProShares Short Real Estate ETF (REK)

Key Statistics

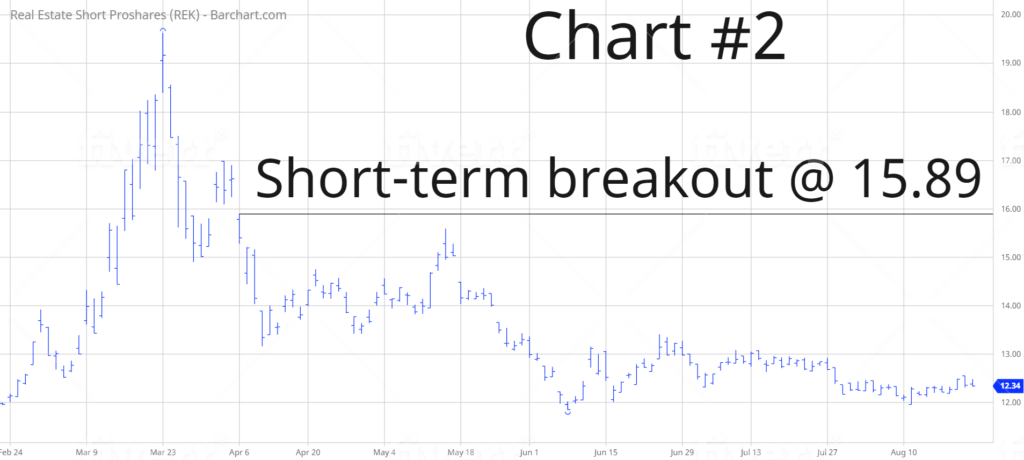

Minor Support Level 11.85 Minor Resistance Level 15.89

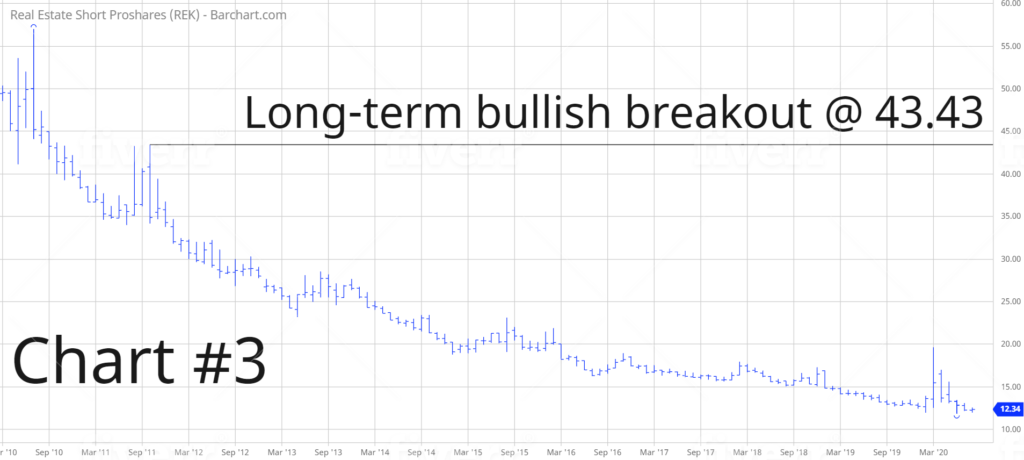

Major Support Level 9.54 Major Resistance Level 43.43

Minor Buy Signal 16.90 Minor Sell Signal 10.97

Major Buy Signal 47.42 Major Sell Signal 5.80

BRIEF OVERVIEW – REK ETF

COVID-19 has impacted several different industries throughout the United States. Unfortunately, many of these industries will never recover to pre-COVID levels. Going forward, the pandemic will completely change the way consumers communicate, work, travel, shop, eat and educate themselves. During the past six months, we have witnessed major disruptions in various industries across the global landscape. Most likely, these disruptions will continue for the next 20 to 30 years.

Industries impacted by COVID-19

- Manufacturing

- Travel

- Retail

- Energy

- Telecommunications

- Healthcare

- Non-profits

- Entertainment

- Colleges & Universities

- Financial Services

- Public Sector

The list is ranked in order beginning with the industry that has suffered the greatest economic impact. Not surprisingly, manufacturing and travel have experienced severe hardships as a result of the global pandemic. As we mentioned, these disruptions will persist for the next several years. This is not a temporary problem.

What is the one common denominator linked to all of these industries? The answer is “commercial real estate.” Each industry on the list owns or leases commercial real estate in order to maintain its operations. If these industries are suffering major contractions across-the-board, what will happen to the value of its commercial real estate? Eventually, the value will plummet. If we examine the list, the hardest hit areas will most likely be colleges & universities, travel and retail. Let’s review the details.

College & Universities – Based on data provided by the National Center for Education Statistics, there currently are 4,298 degree-granting postsecondary institutions in the United States. Many of these institutions were struggling prior to COVID in response to changes in demographics. With the exception of a few years in the 2000s, the US birth rate has been declining for the past three decades. This means colleges are competing for fewer undergraduate students. When COVID entered the picture in February, student population collapsed. Without question, several colleges & universities will not survive the next few years. Consequently, large swaths of land and buildings will become vacant. This will have a devastating effect on commercial real estate prices, particularly in the cities and towns where the campuses are located.

Travel – Prior to the outbreak of COVID, corporations and businesses were slowly transitioning to a remote workforce. Following the COVID outbreak, remote work has exploded. For the past several years, companies have always been hesitant to embrace remote work for fear of declining productivity. However, businesses quickly discovered that worker productivity has actually increased along with the number of remote workers. Most likely, this trend will continue well into the future. Even after a vaccine is discovered and things return to normal, companies have no intentions of returning to an on-site workforce. Remote work is here to stay. Consequently, business travel will never return to its former level. Hotels will become vacant. Additionally, corporate meeting rooms and office space will sit empty. The amount of corporate real estate for sale will increase substantially, causing prices to fall.

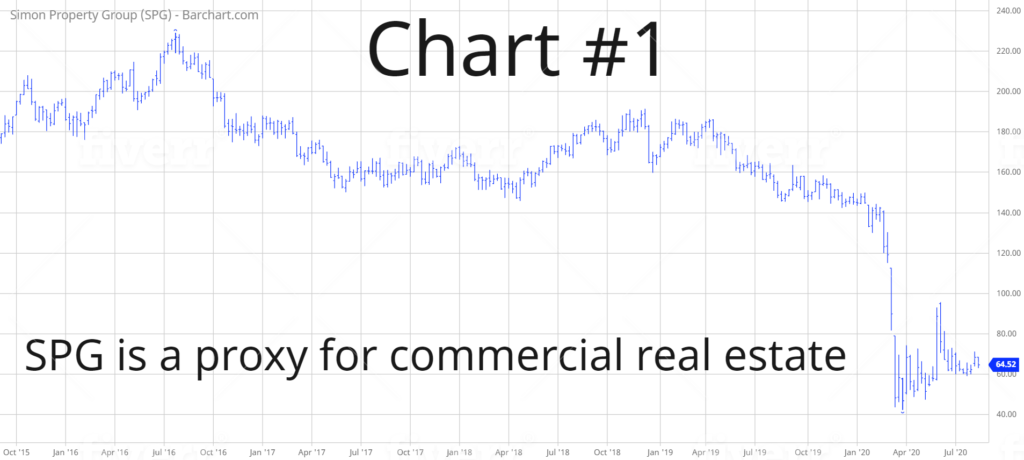

Retail – Thanks to Amazon, brick & mortar retail has been on the decline for the past decade. Unfortunately, the pandemic has accelerated this process. This is particularly true in suburban areas with large shopping centers and indoor malls. During the past few weeks, Amazon, Target, Costco and Wal-Mart have announced dramatic surges in online shopping, home delivery and curbside pickup. Simon Property Group (SPG) is the world’s largest owner of shopping malls. The stock price has plummeted during the past six months in response to a decrease in mall shopping activity. In fact, this stock has been declining for the past five years (Chart #1). Vacancy rates continue to increase in the retail sector, causing real estate prices to suffer.

As you can see, the outlook for commercial real estate is rather bleak. Unfortunately, this trend is far from over. Commercial real estate will struggle for at least the next decade. Historically, commercial real estate cycles are long-term in nature. Whenever a trend is set in motion, it will persist for several years.

In order to provide investors with a vehicle for speculating in declining real estate prices, the ProShares (formerly known as PowerShares) family of exchange traded funds launched the ProShares Short Real Estate ETF using the ticker symbol is REK. The launch date was 16 March 2010. REK is an inverse ETF, meaning that it moves in the opposite direction of the underlying index. In the case of REK, the underlying index is the Dow Jones US Real Estate Index. This is a perfect investment product for speculators who are forecasting lower US real estate prices. The top five holdings include American Tower Corp, Crown Castle International, Prologis Inc, Equinix Inc and Digital Realty Trust.

SHORT-TERM VIEW – REK ETF

Despite the sharp decline in the demand for commercial real estate, prices have remained relatively stable. As a result, REK continues to drift lower. Please remember that REK is an inverse ETF. Therefore, the price moves in the opposite direction of the underlying index. As you know, the underlying index for REK is the Dow Jones US Real Estate Index. The bears are in control of the short-term momentum. The next level of support is 11.85. The bulls need a weekly close above 15.89 in order to recapture the momentum.

LONG-TERM VIEW

Why have commercial real estate prices remained stable in the face of plummeting demand? Because the Federal Reserve has injected $4 trillion into the domestic economy during the past six months. As long as the Fed continues to stimulate the economy with free money, all asset prices will continue to drift sideways-to-higher. However, the likelihood of the Fed continuing to print trillions of dollars on a monthly basis ad infinitum is extremely remote. Eventually, the Federal Reserve will be forced to reduce its money printing, probably because of rising inflation. This is when the value of commercial real estate will really begin to tumble. Please examine the following tables.

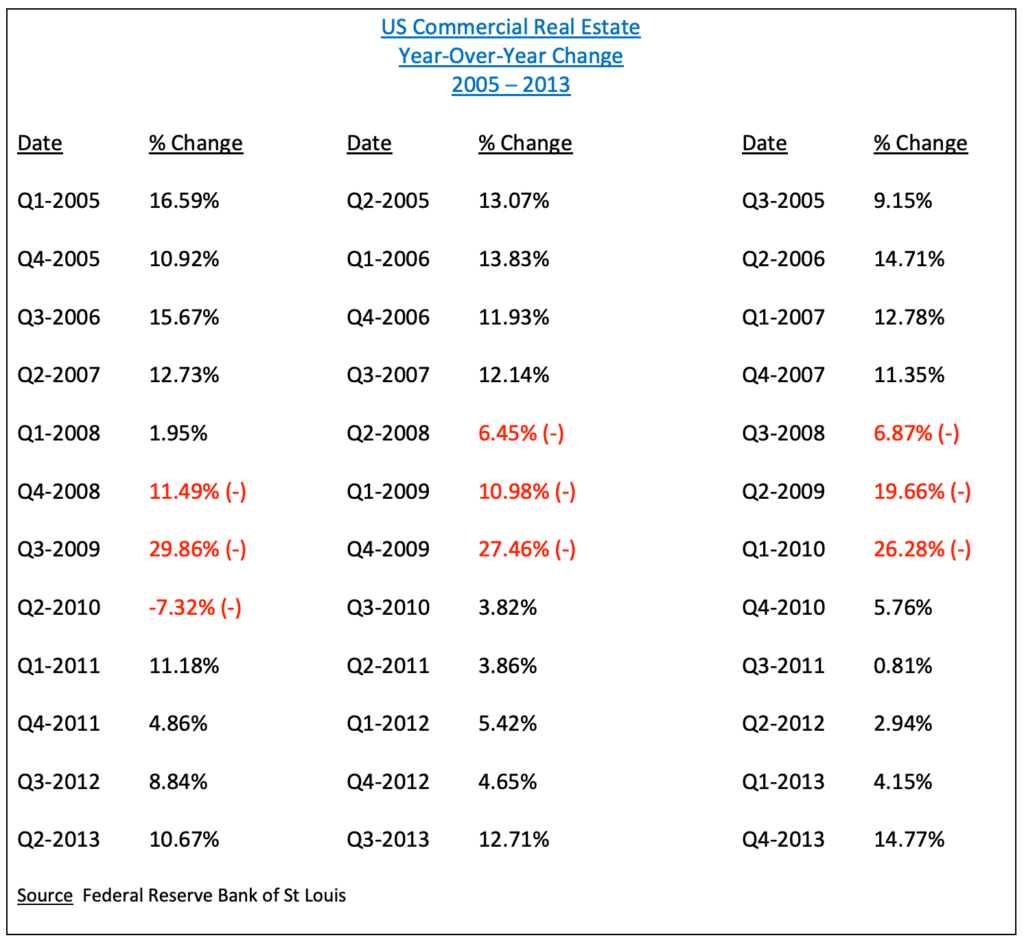

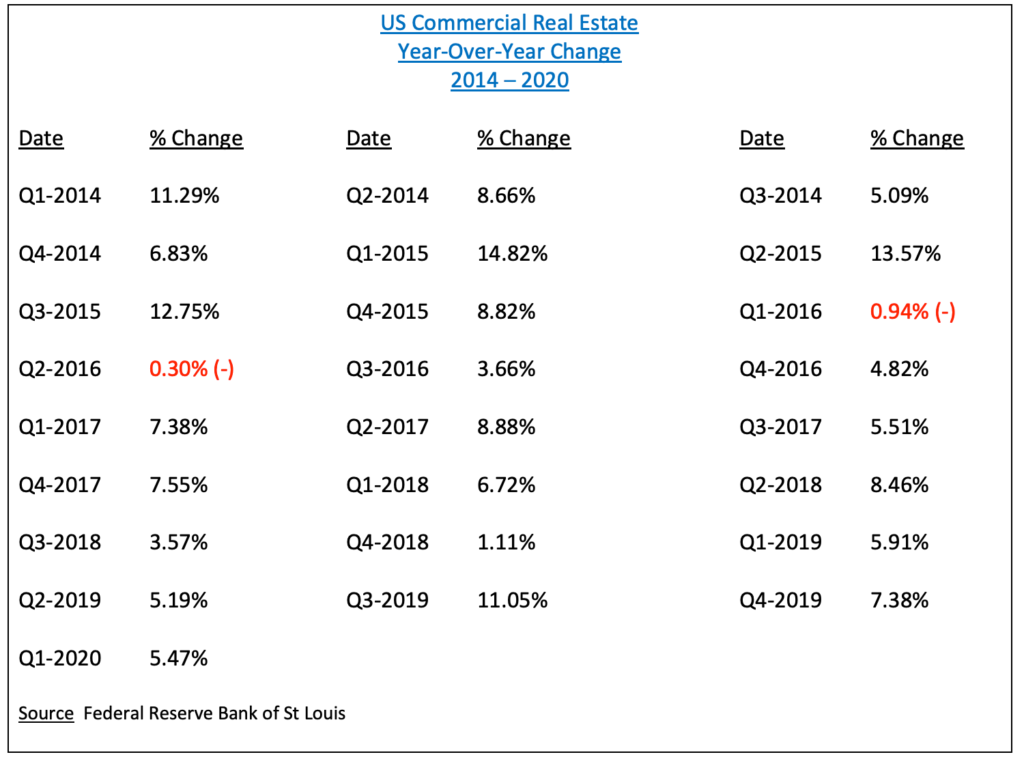

Over the course of the past 15 years, US commercial real estate has been in a spectacular bull market. With the exception of the Global Financial Crisis in 2009, commercial real estate has enjoyed continuous year-over-year price increases. Several of the monthly increases were in double digits, particularly in the years leading up to GFC.

How will COVID affect these numbers? It’s much too early to know for sure. Based on the Q1 numbers, the pandemic has not impacted commercial real estate prices. However, we need at least 4 consecutive data points (i.e. 12 months) in order to draw any conclusions. It’s probably safe to assume that COVID will certainly decrease the demand for commercial real estate. However, we won’t have a good handle on the numbers until early-2021. Please review the following table.

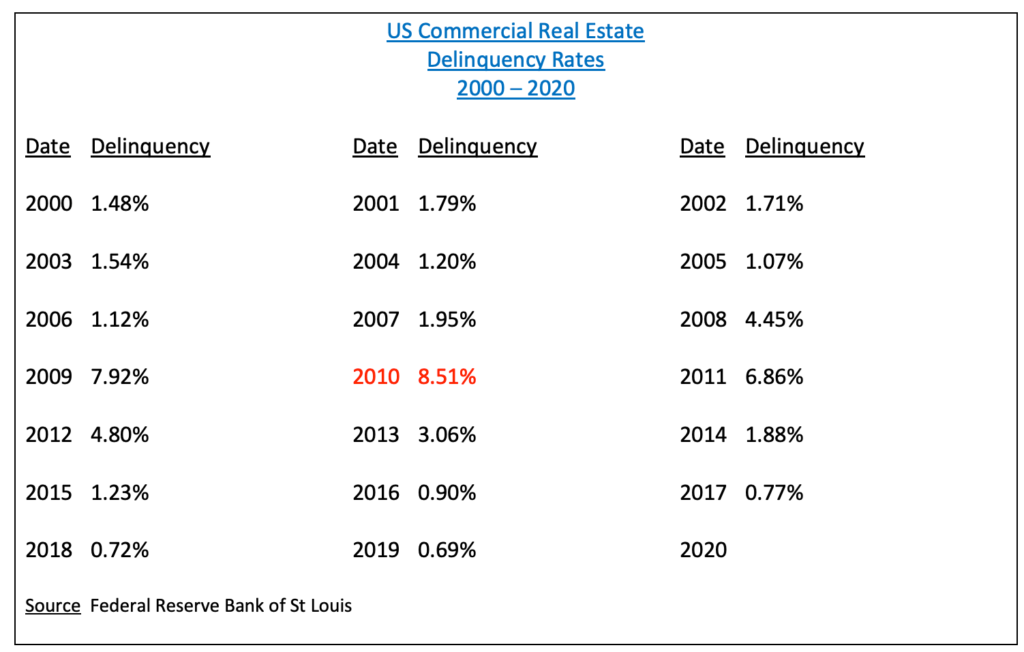

During the past two decades, delinquency rates for commercial real estate have been practically non-existent. The only exception was the impact from the Global Financial Crisis in 2009 and 2010. The St Louis Fed will release the 2020 numbers in early-2021. Real estate experts are predicting a delinquency rate of 4% for 2020. Based on the fact that COVID is a once-in-a-lifetime occurrence, it’s virtually impossible to accurately forecast the numbers for 2020.

Eventually, the domestic economy will recover from the global pandemic. However, experts in the area of sociology and human behavior believe that COVID will create permanent changes in the way people live their daily lives. This will be particularly true in the way people combine their working lives with their personal lives. The United States will experience a cultural shift in favor of more leisure activity combined with a reduced work week. Remote work will allow people to have more free-time. If these societal trends begin to gather momentum, one of the big losers will be commercial real estate. These changes will not occur overnight. “Big picture” macro adjustments usually occur over the course of 10 to 15 years. This explains why commercial real estate prices have remained relatively stable throughout the first six months of the global pandemic.

In regard to REK, the long-term momentum is heavily in favor of the bears. In fact, REK has been drifting lower since the ETF was launched in March 2010. The next level of support is 9.54. In order to reverse the momentum, the bulls need a weekly close above 43.43.

SHORT-TERM CHART

Please review the 6-month chart of REK (Chart #2). The short-term trend is bearish. The next level of support is 11.85. The bulls need a weekly close above 15.89 in order to push the chart into bullish territory.

LONG-TERM CHART

Please review the 12-year chart of REK (Chart #3). Essentially, REK has been in a bear market since the ETF was launched in March 2010. The next level of support is 9.54. The chart pattern will turn bullish on a weekly close above 43.43.