iShares United Kingdom MSCI ETF (EWU)

Key Statistics

Thank you for reading this post, don't forget to subscribe!

Minor Support Level 30.04 Minor Resistance Level 33.99

Major Support Level 23.72 Major Resistance Level 48.60

Minor Buy Signal 34.31 Minor Sell Signal 29.74

Major Buy Signal 52.98 Major Sell Signal 20.78

BRIEF OVERVIEW – EWU

23 June 2016 marked one of the most important days in the history of the British economy. In a fairly close outcome (51.9% to 48.1%), the United Kingdom voted to leave the European Union (EU). This was a landmark decision by the UK because it marked the first time that a participating member state left the EU since its original founding in 1951. Although the “Brexit” vote was held in 2016, it would take an additional four years before the United Kingdom actually withdrew from the EU. The official withdrawal date occurred on 31 January 2020. For the next 11 months, both sides will negotiate their future relationship in terms of economic activity. A final agreement will be released on 31 December 2020.

How will this decision by the United Kingdom affect the future direction of its economy and its level of importance on the global economic stage? Of course, it’s much too early to know for sure. Most economists agree that it could easily take 3 to 5 years before the full impact of Brexit is felt throughout the UK economy. In the meantime, the UK government will attempt to negotiate a pro-growth economic deal with the EU by the end of December 2020.

The iShares family of exchange traded funds (owned by BlackRock) launched the MSCI United Kingdom ETF on March 12, 1996. The ticker symbol is EWU. This ETF is a perfect vehicle for investors who are searching for exposure to companies who generate their revenue from the UK economy. EWU has 103 different holdings. The top five holdings include HSBC, Royal Dutch Shell, BP LLC, British American Tobacco and GlaxoSmithKline.

SHORT-TERM VIEW – EWU

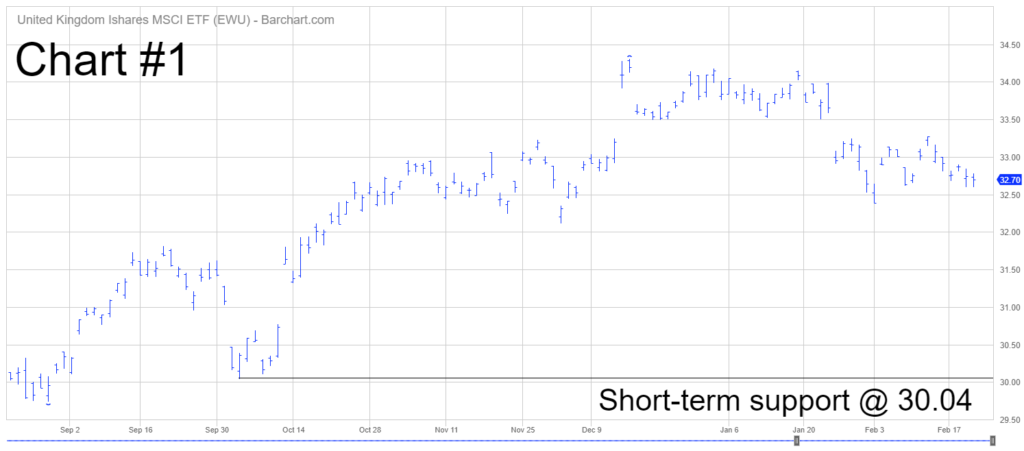

The past 12 months have been a rather uneventful for EWU. The ETF has been locked in a trading range between 30 and 34. Currently, the momentum is slightly in favor of the bearish camp. A weekly close below 30.04 would increase the bearish momentum.

The bears need a weekly close below 30.04 in order to reverse the momentum. The most likely scenario is a continuation of the trading range. EWU could easily remain range-bound for the remainder of 2020.

LONG-TERM VIEW – EWU

Although it’s much too early to know the true economic ramifications of the 2016 Brexit vote, most analysts agree that the UK economy will be negatively impacted going forward. Let’s review a few of the numbers. Please review the following table.

United Kingdom

Gross Domestic Product

Date %GDP Date %GDP Date %GDP

2000 3.7% 2001 2.5% 2002 2.5%

2003 3.3% 2004 2.4% 2005 3.1%

2006 2.5% 2007 2.4% 2008 0.5% (-)

2009 4.2% (-) 2010 1.7% 2011 1.5%

2012 1.5% 2013 2.1% 2014 3.1%

2015 2.3% 2016 1.9% 2017 1.8%

2018 1.4% 2019 1.2%

Source International Monetary Fund (IMF)

As you can see from the table, Brexit is already having a negative effect on the UK economy (even though it did not become official until 31 January 2020). In 2019, the United Kingdom experienced its lowest rate of economic growth since the Global Financial Crisis. Why is Brexit causing the UK economy to slow down? More importantly, what did voters gain by agreeing to leave the European Union?

Economically speaking, the root cause of the country’s slow growth is its loss of tariff-free trade status with the other EU members. This is the driving force which will prevent an increase in economic activity throughout 2020 and 2021.

Generally speaking, tariffs raise the cost of exports. Consequently, UK companies will find themselves at a competitive disadvantage because their goods and services will be priced at a higher level (as a direct result of the tariff). Additionally, import prices will increase, which will allow domestic companies inside the UK to raise their prices. Of course, these higher prices will trickle down to consumers, which will ultimately lower their standard of living.

Quite possibly, the industry that will face the greatest disruption will be the financial services industry. London’s financial district (more commonly known as The City) will no longer be the base for companies that use it as an English-speaking entry into the EU economy. Real estate owners and developers are concerned that there could be a mass exodus of firms leaving The City beginning in 2020. In fact, the transition away from London’s financial district may have already begun. Several real estate projects have been placed on hold until financial firms have a more clear understanding of how Brexit will change The City. There is a very real possibility that the financial services industry could move elsewhere. Consequently, real estate prices could plummet.

In addition to the financial services industry, the UK construction industry could also suffer as a result of Brexit. Effective 31 January, UK construction companies no longer have the ability to bid on public contracts in any EU country. For the past several years, these public contracts were a large source of revenue for UK construction companies.

UK companies involved in the travel and leisure industry are also concerned about the ramifications of Brexit, particularly as it relates to Ireland. Northern Ireland will remain with the UK, while southern Ireland remains part of the EU. The beautiful island of Ireland is a major vacation destination for UK citizens. However, it will certainly be more difficult for UK travel companies to promote Ireland as a vacation getaway.

In terms of major advantages, the UK will be relieved of the burden of allowing the free flow of people into the United Kingdom from all other EU member countries. In fact, this is the main reason why UK citizens voted in favor of Brexit. They were concerned about an increase of refugees from Africa and the Middle East.

An additional Brexit benefit is the UK government’s ability to levy taxes without following EU guidelines. As an added bonus, the United Kingdom won’t have to pay EU membership fees.

At this point, it’s much too early to accurately determine how Brexit will change the economic landscape in the UK. The true ramifications won’t be realized at least for another decade. However, it’s safe to say that Brexit will certainly cause many economic disruptions as the UK slowly moves away from the EU.

In regard to the long-term momentum, EWU has been locked in a trading range for the past ten years. With the exception of a few months, EWU has been trading between 30 and 40 since the summer of 2010. The momentum will turn bullish on a weekly close above 48.60. A weekly close below 23.72 will swing the momentum in favor of the bears. Currently, the bears have a slight advantage.

SHORT-TERM TREND

Please review the 6-month chart of EWU (Chart #1). The chart pattern is beginning to roll over to the downside in favor of the bearish camp. A weekly close below 30.04 would accelerate the move to the downside. A short-term bullish breakout would occur on a weekly close above 33.99.

LONG-TERM TREND

Please review the 20-year chart of EWU (Chart #2). This ETF is one of the few securities that generated a multi-year high and multi-year low in the course of less than two years. In October 2007, EWU recorded its all-time high @ 54.76. Eighteen months later (March 2009), the all-time low was achieved @ 17.76.

During the past decade, EWU has frustrated both the bulls and the bears by drifting sideways between 30 and 40. Most likely, investors can expect more of the same until the financial community can gain a better understanding of the economic realities of Brexit.