ETFMG Prime Cyber Security ETF (HACK)

Key Statistics

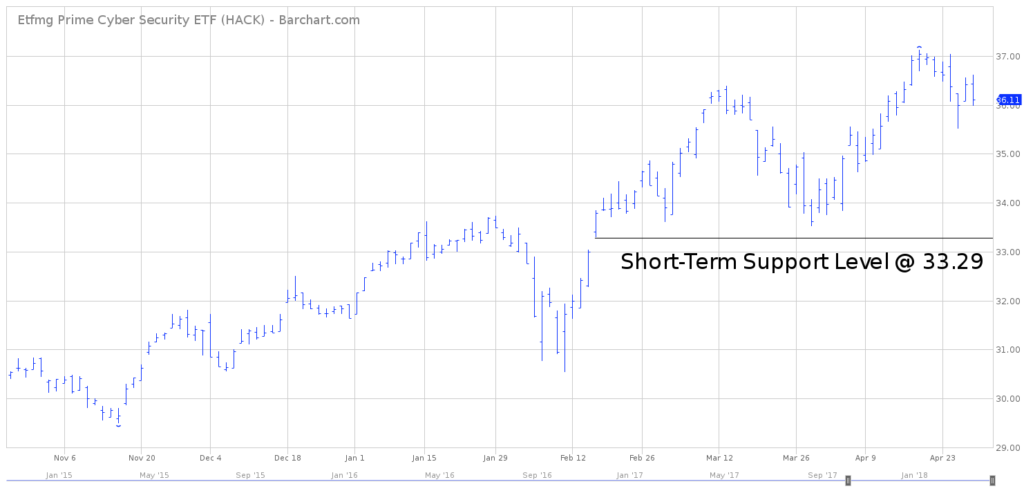

Minor Support Level 33.29 Minor Resistance Level 37.13

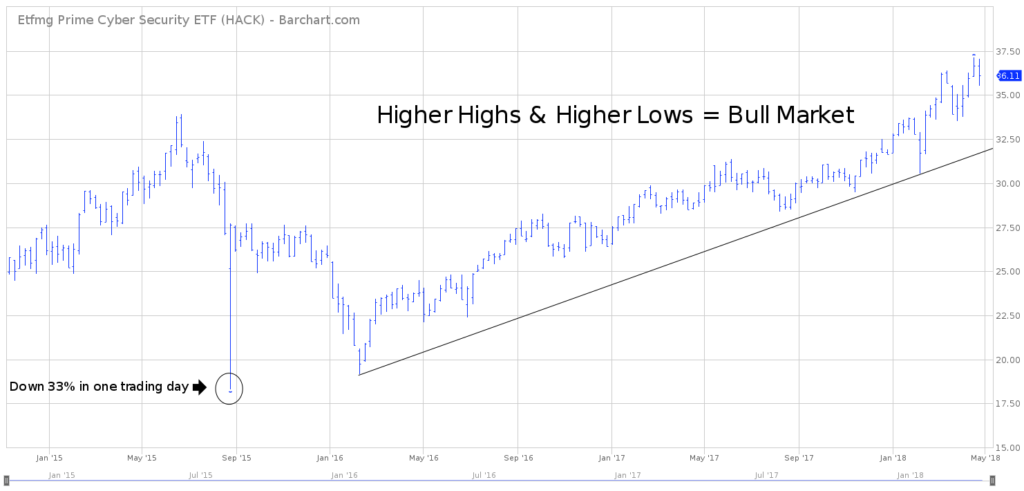

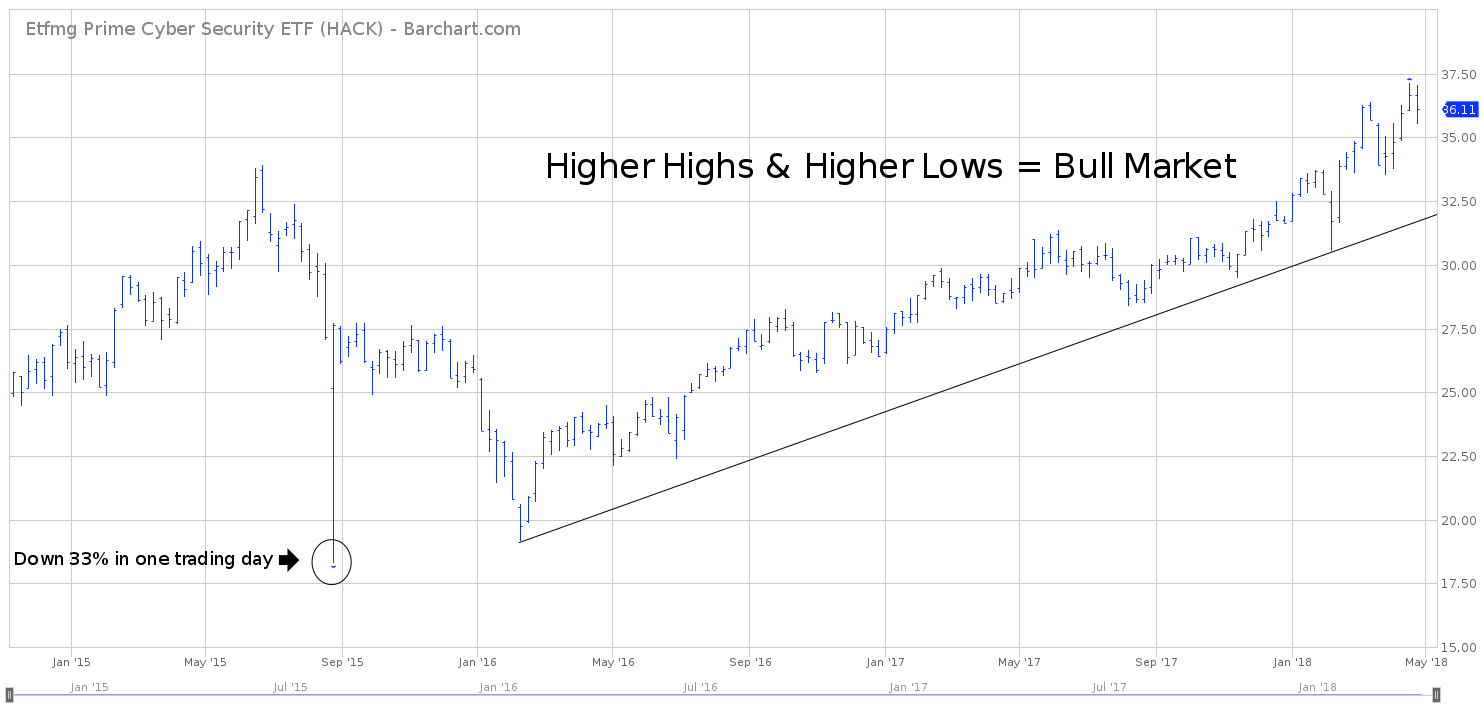

Major Support Level 20.68 Major Resistance Level 37.13

Minor Buy Signal 39.72 Minor Sell Signal 32.27

Major Buy Signal 43.45 Major Sell Signal 18.29

BRIEF OVERVIEW – Prime Cyber Security ETF HACK

Without question, one of the fastest growing industries on a global basis is the cybersecurity industry. In 2004, the industry was valued at a paltry $3.5 billion. By the end of 2017, spending on global cybersecurity had exploded to $120 billion. This represents an increase of 3,328% over the course of the past 13 years. No other major industry even comes close to matching this type of growth rate. By 2023, cybersecurity spending is projected to reach $165 billion. There appears to be no end in sight.

What exactly is cybersecurity and why has the industry increased so dramatically during the past decade? Cybersecurity is the protection of computer systems from the theft and damage to their hardware, software or information. It also protects from the disruption of services they provide. The industry is growing so dramatically due to the increasing reliance on computer systems and the internet. This would include such things as wireless networks (i.e. Bluetooth and Wi-Fi) as well as “smart” devices like smartphones and televisions.

In an effort to provide investors with exposure to the cybersecurity industry, the ETFMG family of exchange traded funds launched the Prime Cyber Security ETF on November 12, 2014. The ticker symbol is HACK. This investment product is the world’s first ETF focused on the cybersecurity industry. More specifically, HACK is comprised of companies that offer hardware, software and consulting services designed to defend against cybercrime. The ETF includes 47 different holdings. The top five holdings are Commvault Systems Inc, Trend Micro Inc, Science Applications International Corporation, Palo Alto Networks Inc and Fortinet Inc.

SHORT-TERM VIEW -Prime Cyber Security ETF HACK

HACK has enjoyed a substantial rally over the course of the past ten weeks. The bulls are in complete control of the short-term view. The next level of resistance is the all-time high posted on Apr 18th, @ 37.13. The bears need a close below 33.29 in order to reclaim the momentum on a short-term basis. The most likely scenario is a continuation of rising prices.

Based on the Aroon Oscillator, HACK has a slightly overbought reading of +56. The Aroon Oscillator is programmed differently than most stochastic indicators. The oscillator fluctuates between -100 and +100. A reading of 0 would indicate a neutral position. Therefore, a reading of +56 with HACK is considered moderately overbought. The ETF is probably in store for a short-term correction.

LONG-TERM VIEW -Prime Cyber Security ETF HACK

In many respects, the cybersecurity industry is still in its infancy stage. In fact, the industry didn’t even exist until the internet became a part of our daily lives beginning in the mid-1990s. These days, companies are spending huge amounts of money on cybersecurity in order to prevent computer viruses and the theft of personal data. Let’s review a few of the industries with the largest cybersecurity budgets.

In terms of cybersecurity vulnerability, the financial services industry has the potential to suffer the greatest loss. These losses could occur from a financial standpoint as well as customers losing faith in the products and services.

Hackers are constantly targeting financial regulators and financial institutions in an effort to manipulate the markets and generate illicit gains. The financial regulators most at risk include the Securities and Exchange Commission, the Federal Reserve and the SWIFT network. In regard to financial institutions, commercial banks, brokerage firms, investment banks and credit card companies pose the greatest amount of risk to individual consumers. Additionally, any website or smartphone app that stores sensitive financial information would be a prominent hacking target.

The utilities industry is another area of major concern by cybersecurity experts. Technology has completely altered the way businesses and consumers receive utility services. During the past two decades, computers have played an ever increasing role in controlling the functions at most utility companies. This includes the coordination of telecommunications, the power grid, nuclear power plants as well as valve openings and closings in water and gas networks. Any type of cyberattack in the utilities industry would cause major disruptions to our way of life.

The aviation industry is also vulnerable to cyberattacks. The industry uses a series of complex systems in order to operate on a daily basis. A simple power outage at one airport can cause repercussions on a worldwide basis. Much of the aviation industry relies on radio transmissions, which can easily be disrupted by a cyberattack. An additional source of vulnerability is the safety of aircrafts over ocean waters. Radar surveillance only extends 200 miles offshore. Therefore, the aviation industry must be constantly on guard against even the slightest cyber threat.

In addition to financial institutions, large corporations are common targets of cyberattacks. The most common type of cyberattack involves identity theft and the breach of personal data. An example would include the loss of customer credit card numbers. During the past few years, several corporations became victims of credit card theft. The most prominent names were Home Depot, Staples and Target Corporation. Of course, the greatest security breach on record belongs to Equifax, where a total of 150 million customer profiles were reported stolen in September 2017. Most likely, cyberattacks will continue to increase against large corporations based on the fact that these firms control such large amounts of personal data.

As you can see, there exists an enormous amount of vulnerabilities throughout the domestic economy. This explains why the cybersecurity industry will continue to enjoy double digit growth rates well into the next decade. Most likely, artificial intelligence (AI) will be the “key” to reducing the number of cyberattacks throughout the global economy. However, AI is a relatively new concept, particularly in terms of its application in preventing cybercrimes. Therefore, the cybersecurity industry will continue to be a major revenue generator for the next several years.

The long-term view of HACK remains quite bullish. Of course, the ETF has only been in existence for 3 ½ years. Therefore, HACK has a limited amount of historical data. Nevertheless, the bulls have been in complete control of HACK for the past two years. The ETF has basically gone straight up since February 2016. The next level of resistance is the all-time high from April 16th @ 37.13. The bears need a weekly close below 20.68 in order to recapture the downside momentum.

SHORT-TERM TREND – Prime Cyber Security ETF HACK

Please review the 6-month chart of HACK. The short-term chart pattern remains quite bullish. The next level of resistance is the April 18th high @ 37.13. A weekly close below 33.29 will turn the chart pattern in favor of the bears. At least for now, the most likely scenario is a continuation of the bullish trend.

LONG-TERM TREND – Prime Cyber Security ETF HACK

Please review the 3-year chart of HACK. This chart contains the entire trading history of HACK. Therefore, it’s rather difficult to generate a long-term forecast. However, based on the current price data, the bulls are in complete control of HACK. The ETF has enjoyed a continuous grind to the upside since February 2016. There’s absolutely no indication to expect a bear market reversal any time in the near future.

Please notice the brutal intraday decline on August 24, 2015. At one point during the trading session, HACK was down 33%. This date marked the lowest price level in HACK’s trading history. This is a perfect example of the volatile nature of financial markets. These markets can begin to unravel very quickly. We must always respect the incredibly volatile nature of all financial markets.