Vanguard Real Estate ETF (VNQ)

Key Statistics

Thank you for reading this post, don't forget to subscribe!

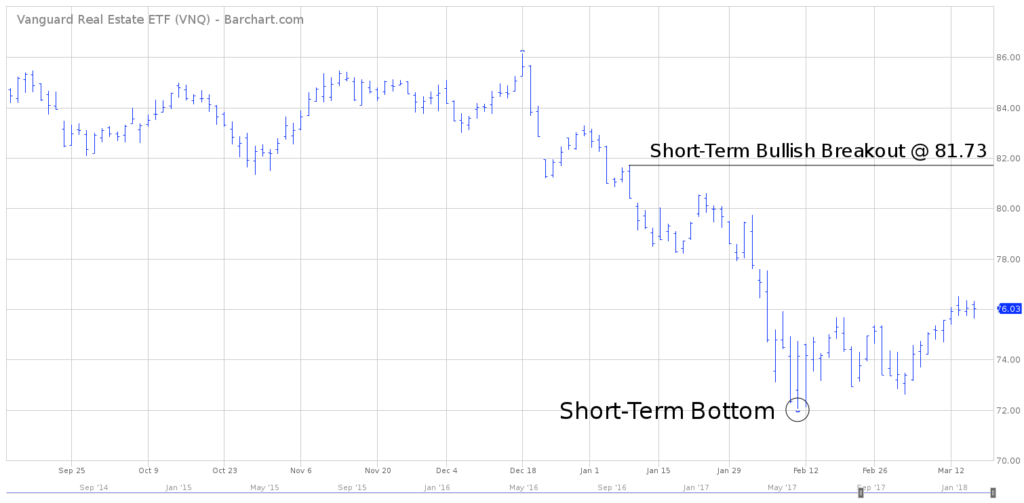

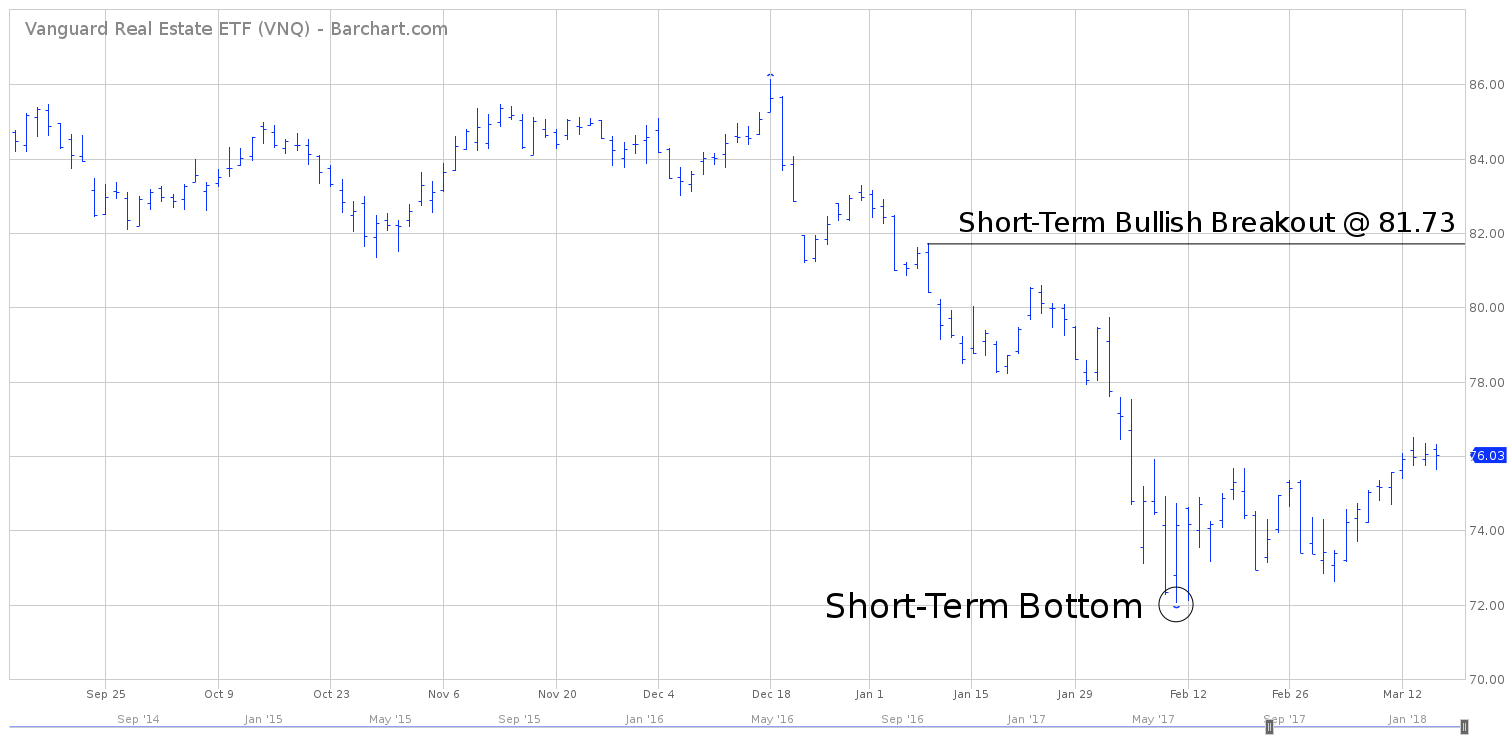

Minor Support Level 72.62 Minor Resistance Level 81.73

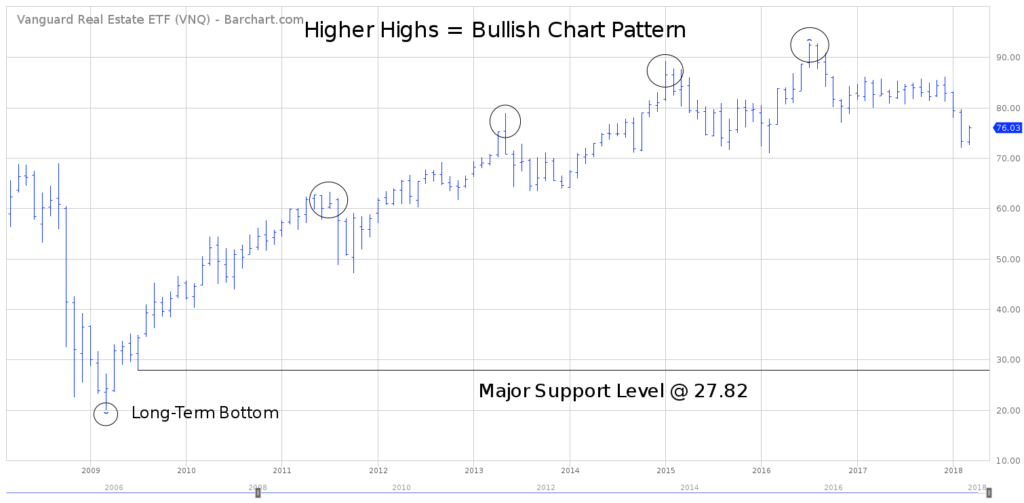

Major Support Level 27.82 Major Resistance Level 88.67

Minor Buy Signal 82.93 Minor Sell Signal 72.05

Major Buy Signal 92.92 Major Sell Signal 25.45

BRIEF OVERVIEW – Vanguard Real Estate ETF VNQ

In 1897, while on a speaking tour in London, the great Mark Twain was quoted as saying, “The rumors of my death have been greatly exaggerated.” Indeed, the rumors of Twain’s death were exaggerated, as Twain lived another 13 years, dying of a heart attack in 1910.

In terms of economic and social trends, it appears that America’s shopping malls are experiencing the same rumors that Twain encountered in 1897. According to the rumor mill within the financial community, shopping malls are practically dead. The obituary has been written.

Every few weeks within the financial media, there’s a new story proclaiming the death of America’s shopping malls. It appears that everyone has jumped on the “malls are dead” bandwagon. Are shopping malls dead? Or have the rumors been “greatly exaggerated?” Let’s examine the details.

Before we dive into the numbers, it should be noted that the International Council of Shopping Centers defines an indoor shopping mall as having a minimum of 400,000 square feet of retail space. Officially, these structures are known as regional centers.

Edina, MN was home to the first indoor shopping mall in the United States. It arrived on the scene in 1956. This marked the beginning of “the malling of America.” Over the course of the next 40 years, indoor shopping malls exploded in popularity. By the late 1980s, over 60 regional centers per year were being constructed throughout the United States. The market reached its peak in 1995, when 140 indoor shopping malls were constructed in a single year. During the next ten years (1996 thru 2006), the market remained fairly steady, as 40 to 60 new facilities were added on an annual basis.

The financial crisis of 2008 was responsible for wreaking havoc in several industries throughout the United States. Unfortunately, indoor shopping malls did not escape the carnage. As the economy was grinding to a halt leading up to the financial crisis, not a single indoor shopping mall was built in the United States in 2007. This marked the first time since 1957 that a new facility was not opened for business.

The total number of US shopping malls (greater than 400,000 sq ft) reached its zenith in 2007 @ 1,300 locations. By the end of 2017, the number had dwindled to 1,100 locations. This represents a decline of 15% over the course of the past decade.

Clearly, indoor shopping malls have struggled during the past decade. Of course, the same thing can be said about many industries, particularly in regard to the retail space. However, that doesn’t mean that we should sound the death knell for America’s shopping malls. The jury’s still out.

In an effort to provide investors with exposure to America’s shopping malls and other real estate properties, the Vanguard family of exchange traded funds introduced the Vanguard Real Estate ETF on September 23, 2004. The ticker symbol is VNQ. The ETF has 183 different holdings. Its largest holding is Simon Property Group (SPG), a self-managed real estate investment trust (REIT). SPG owns and manages 108 shopping malls across the United States.

The company is the largest owner of shopping malls and factory outlet stores in the US. In terms of ETFs, VNQ is the largest single shareholder of Simon Property Group.

SHORT-TERM VIEW – Vanguard Real Estate ETF VNQ

VNQ has been drifting lower for the past 90 days. The bears are in complete control of the short-term momentum. The next level of support is 72.62. In order to recapture the upside momentum, the bulls need a weekly close above 81.73.

It does appear that VNQ generated a short-term bottom on February 9th @ 72.05. However, the momentum will remain bearish until VNQ generates a weekly close above 81.73. At least for now, the path of least resistance is to the downside.

LONG-TERM VIEW – Vanguard Real Estate ETF VNQ

The entire retail industry in the United States is experiencing a major upheaval, as consumers change their shopping and spending habits. This includes shopping malls, factory outlet shops and all traditional brick & mortar locations. Of course, this is not a new phenomenon. These problems within the retail industry have been brewing for the past 10 to 15 years.

In regard to shopping malls and shopping centers, the peak occurred in 2003, as 76% of all retail sales occurred inside these types of retail establishments. Since 2003, this number has been slowly declining. The main culprit has been online shopping. Of course, this only explains part of the problem. Online shopping is not the sole reason why brick & mortar retail sales have declined. There are other concerns.

A large part of the problem facing the retail industry is the change in demographics throughout the United States. During the past 5 to 7 years, baby boomers have been retiring at a rate of 10,000 per day. As they retire, their spending habits begin to shrink. Unfortunately, for the shopping malls and other retail establishments across the United States, this trend will only grow worse over time.

Baby boomers were the driving force behind the dramatic surge in brick & mortar retail activity throughout the 1980s, 1990s and early 2000s. This explains why over 100 regional shopping centers per year were built throughout the 1990s. As we discussed previously, the building of indoor shopping malls peaked in 2007, just as the baby boomer generation was slowly beginning to curtail its spending activity. This is certainly not a coincidence. Instead, it verifies the fact that demographics play a huge role in determining the fate of the retail industry.

As the baby boomers are enjoying their golden years of retirement, the millennials are slowly becoming the dominant generation in the United States. In fact, by 2019, millennials will surpass baby boomers as America’s largest generation. In 2019, the millennial population will swell to 73 million, as they become the trend setters in terms of spending habits and shopping patterns. However, this generation will not reach its peak earnings potential until the early 2030s. Consequently, the US could experience a slight decrease in overall economic activity between 2020 & 2030, while the millennial generation is building its earnings potential.

How will this generational shift (from baby boomers to millennials) affect indoor shopping malls, outlet malls and other retail establishments? Admittedly, the next decade could be rather challenging for the brick & mortar retail industry. However, the retail industry is making the necessary adjustments to prepare for this slowdown in spending activity. For example, several major retail establishments are closing stores and downsizing their operations in an effort to become leaner and more financially stable. In regard to shopping malls, as we discussed previously, 200 shopping malls have been closed during the past decade. The underperformers are being discarded, which is a smart financial decision.

The truth of the matter is, shopping malls (along with brick & mortar stores) are not dead. On the contrary, they are undergoing a much needed facelift and revitalization. The underperforming stores and malls are being shut down in order to preserve capital as the millennial generation starts driving the economic engine throughout the next decade.

On a long-term basis, the current pruning of America’s malls and shopping establishments is actually quite bullish. During the next great spending boom (which will be fueled by millennials), the brick & mortar retail industry will be much leaner and meaner as it continues to compete with the online retailers for customers.

The next time you read a long-winded article about the death of shopping malls, outlet malls and traditional retailers, it would probably be a good idea to take it with a grain of salt. These days, all financial pundits are forecasting the demise of America’s brick & mortar retail industry. Therefore, it would be wise to take a contrarian viewpoint and move in the opposite direction.

VNQ has been pushing its way higher for the past nine years. The long-term momentum is definitely in favor of the bulls. The next level of resistance is 88.67. VNQ formed an important bottom in March 2009, along with the overall stock market. Essentially, this ETF has been riding the coattails of the broad market since 2009.

In order to recapture the downside momentum, the bears need a weekly close below 27.82. The most likely scenario is a continuation of the long-term bullish momentum.

SHORT-TERM CHART – Vanguard Real Estate ETF VNQ

Please review the 6-month chart of VNQ. The short-term chart pattern is bearish. The next support level is 72.62. The chart pattern will remain bearish until the bulls can generate a weekly close above 81.73.

LONG-TERM CHART – Vanguard Real Estate ETF VNQ

Please review the 10-year chart of VNQ. The long-term chart pattern is quite bullish. For the past nine years, VNQ has recorded a string of higher highs. This is a classic definition of abullish chart pattern. It’s highly unlikely VNQ will penetrate the major support level any time in the near future.