A very common question I get is what about the leveraged Exchange Traded Funds? Using a Leveraged ETF can certainly turn investing into more of a speculative trading direction.

Thank you for reading this post, don't forget to subscribe!With the QLD (Proshares 2:1 Leveraged QQQ) you are trading with margin of 2:1. This can be advantageous when you consider that in a typical retirement account such as an IRA, 401K, SEP you usually cannot use any leverage.

You’ve seen from some other ETF results that using the 2:1 margin in a non-retirement account can definitely power up your investment return, and in reality still lead to a maximum drawdown far less (usually) than normal buy and hold.

Which brings us to the leveraged ETFs. A couple of rules that I follow that I would suggest you consider:

- Do not short these vehicles. I know it can be tempting to think in a non-retirement account why not short when the market is in a sell signal. Leveraged ETFs do not behave the same way as a straight cash ETF, and I would not suggest shorting.

- Do not trade these buy and hold. Why? When the market is in a drawdown, at 2:1 leverage you can see drawdowns of 90%+!

To me, if you want to consider these, you really should use a methodology like ours. You know that we’ll go to the sidelines in extreme market weakness. While we can’t make a market go up, we can at least avoid the worst part of the wipeout.

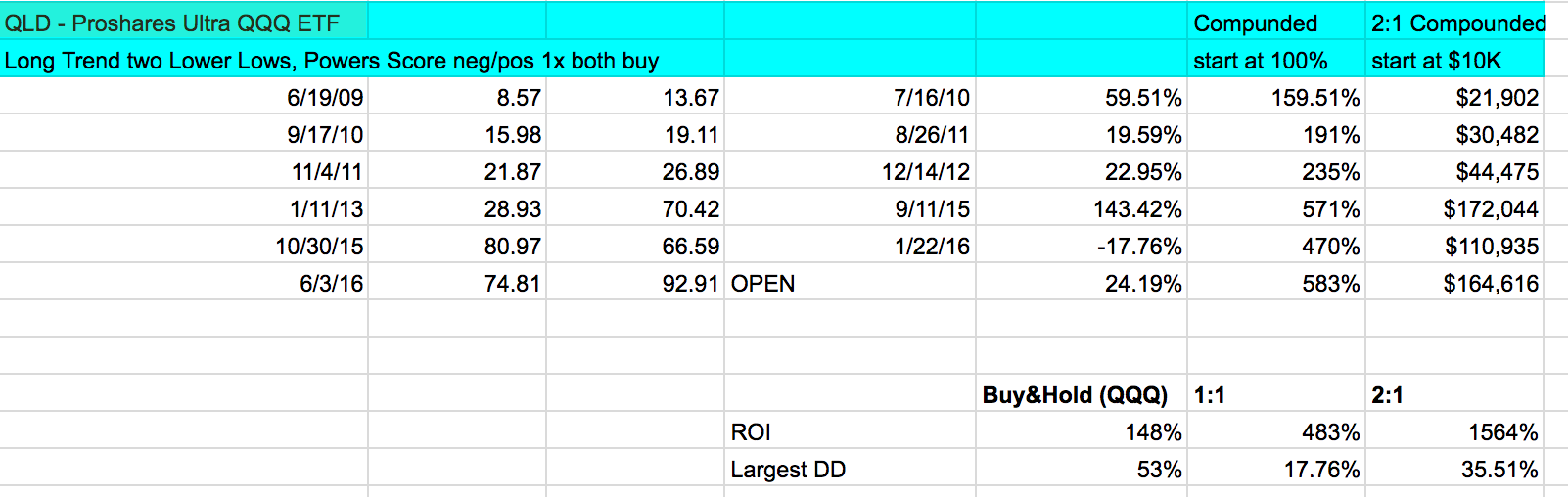

Take a look at these results using our main approach trading the QLD:

In about the 10 year period (before the first trade we were flat for some time in a decline) you only had to take 6 trades. Next, you can see that this crushed straight buy and hold of the underlying Nasdaq 100 index returning 483% vs 148%. That’s over 3X the return. Plus, we so far have had a max drawdown of about 18%. This is definitely larger than our regular 1:1 QQQ trading, but certainly still far lower than buy and hold which was 53%.

Now, just for fun, I took a look at trading the leveraged QLD WITH leverage! Starting with $10K, it turned into $164,616 over this period! Exciting right? Would I recommend this? Not really unless you were trading a very small percentage and called it risk capital. The reason? Drawdowns can get much higher – surprisingly STILL less than buy and hold on the QQQ but nevertheless it can lead to a roller coaster ride of emotions.

At any rate, you can see trading the QLD vs. QQQ in a retirement account can certainly power up your returns. You just have to be very aware that drawdowns are going to be larger. We still should beat buy and hold, but be prepared to see your equity face drawdowns over the years. If we can repeat this the next 10 years, I’d take that any time.