You’ve seen from our last blog post some results over the last 10+ year period trading larger cap ETFs. You can review that here.

Thank you for reading this post, don't forget to subscribe!We’ve pointed out that one of the real advantages of this type of ETF trading strategy is the ability to get out of the way of the very large drawdowns that occur in bear markets.

Amongst your options when trading Exchange Traded Funds are sector based ETFs. There are a number of these across a spectrum. Gold. Steel. Coal. Semiconductor. Biotech. Internet. And the list goes on.

Typically, we would not suggest you build a long-term ETF portfolio with a large allocation towards sector based ETFs. However, it’s likely that you have some ideas about what sectors might benefit in the coming years based upon global economic conditions and politics. You can look now at the strongest sectors in our overall ETF Quintile Heatmap and it might not be a surprise at all given the incoming administration in the U.S. that you have a lot of old industries leading the performance right now. Energies. Coal. Steel. Banking.

One of the real advantages is we can position ourselves and make some bets on timing sectors at least with a small percentage of our portfolios. These are educated bets to some degree. Bets because let’s face it, none of us has the ultimate crystal ball. What we do know is if we’re wrong we will not be subjected typically to massive drawdowns.

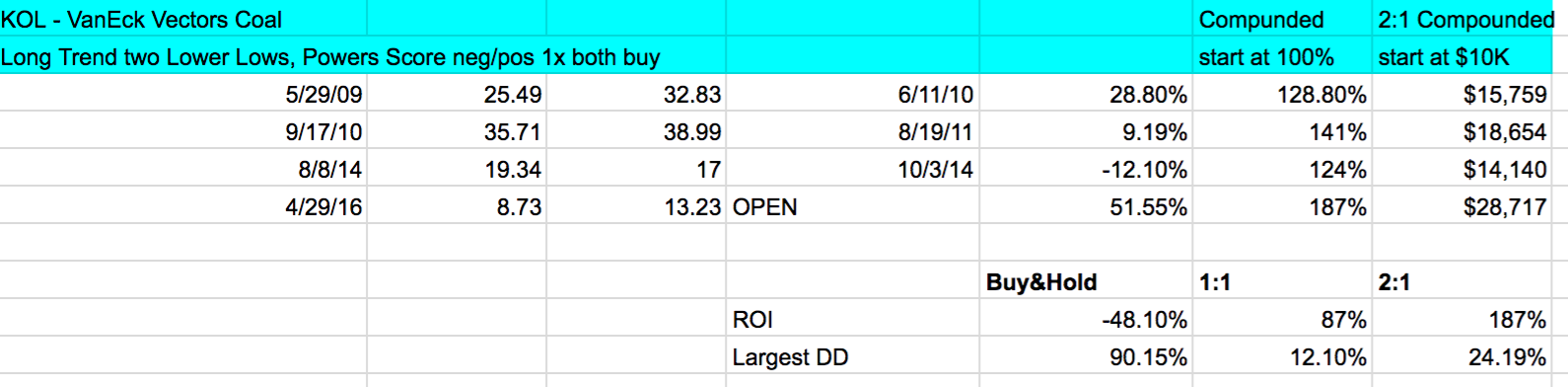

Case in point the Coal ETFs. What a roller-coaster in the last 10+ years. You’ve got drawdowns for buy and holders of over 90%, and another of 84%! Talk about painful. With one of our suggested models however you avoided virtually all of that:

However, it’s important to keep in mind that we’ll likely underperform a sector that goes on a long-term upswing. We will be able to avoid the worst drawdowns, but you do need to realize the trade-off from that drawdown safety and losses is we’re likely to underperform buy & hold at times, perhaps even for an extended period:

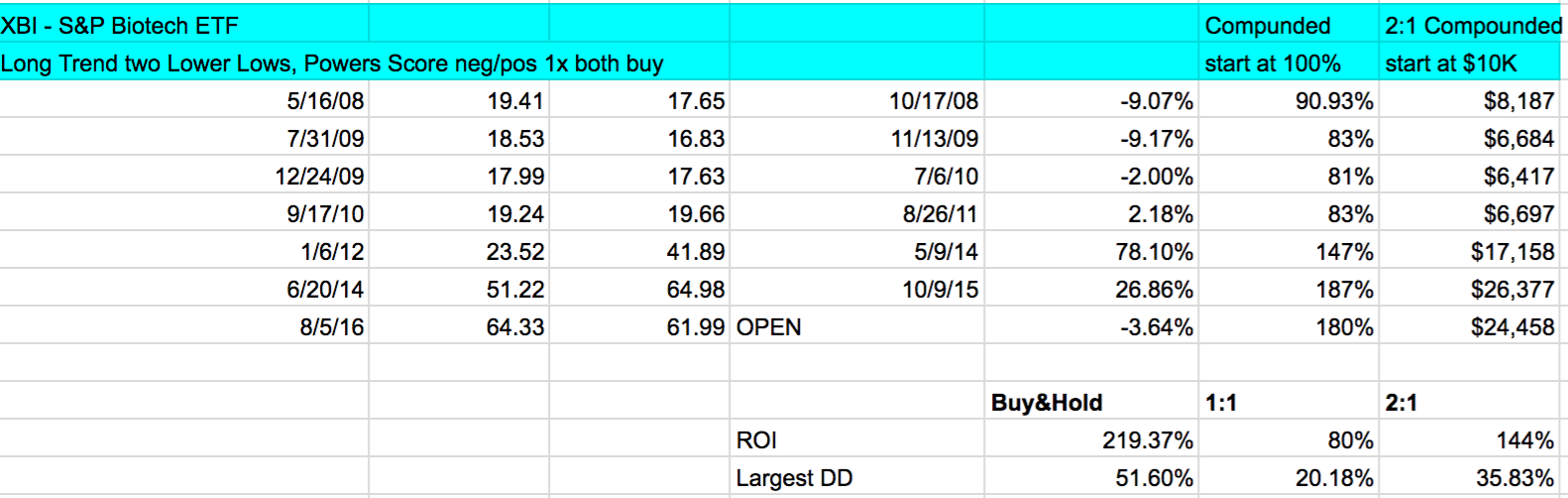

You can see with the Biotech sector that we did a nice job avoiding very large drawdowns, and there were several more above 30% besides the max drawdown of 51%. But, the only way we came close to the overall buy & hold was with some use of margin.

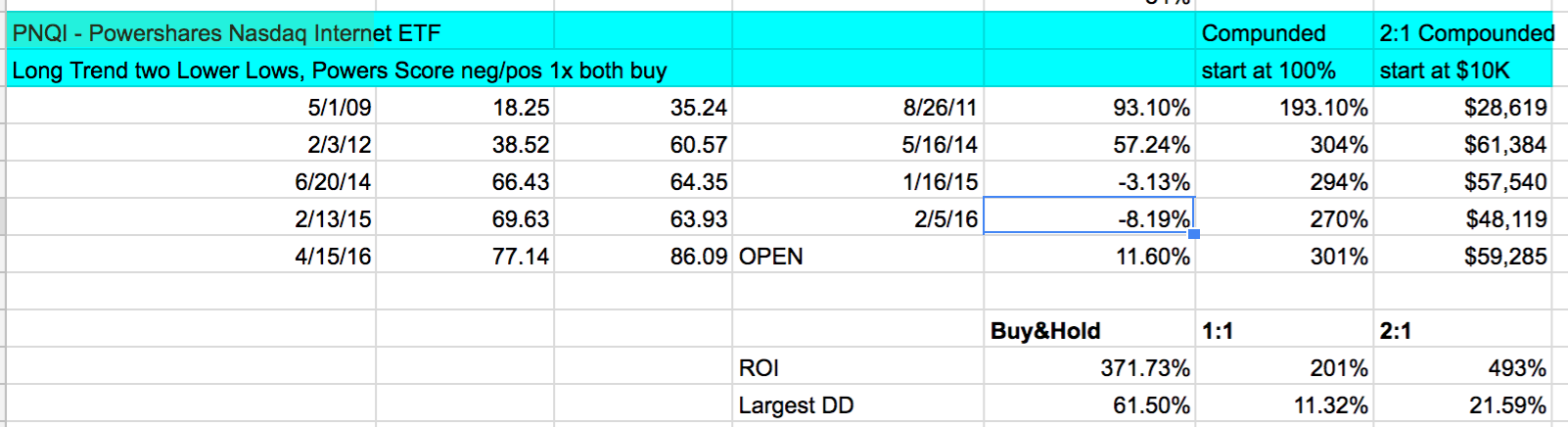

Here’s the Nasdaq Internet ETF. I’d take our return any time over the large buy & hold drawdowns but once again, without some margin we did lag.

You can see your trade off. In the case of Coal, we crushed the return and protected capital. In the case of markets that have gone on some multi-year bull markets we may see variance from beating, to meeting to even lagging buy and hold. Through it all though we should always see that in the bear markets, we’re in good shape while the buy and hold crowd are suffering. For sector bets, this is a trade-off I’d like to take. Plus, keep in mind you probably normally aren’t looking at these bets for years or decades at a time. Find your spots, allocate a modest percentage, and with our models, you will stay out of harm’s way.