Bitcoin Investment Trust (GBTC)

Key Statistics

Thank you for reading this post, don't forget to subscribe!

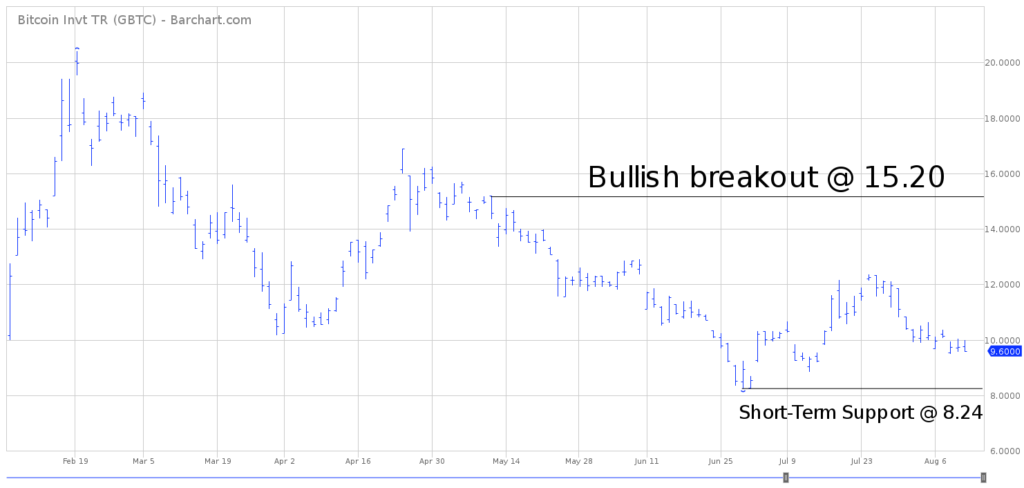

Minor Support Level 8.24 Minor Resistance Level 15.20

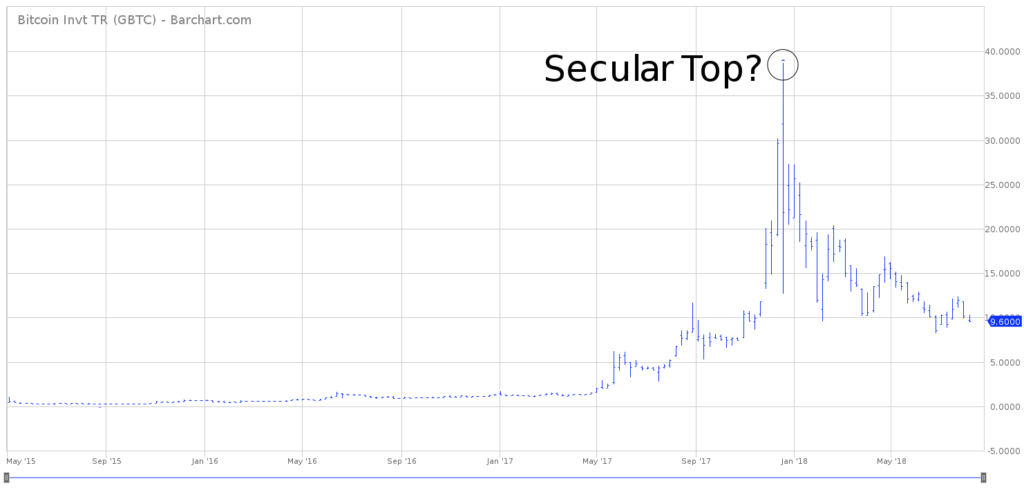

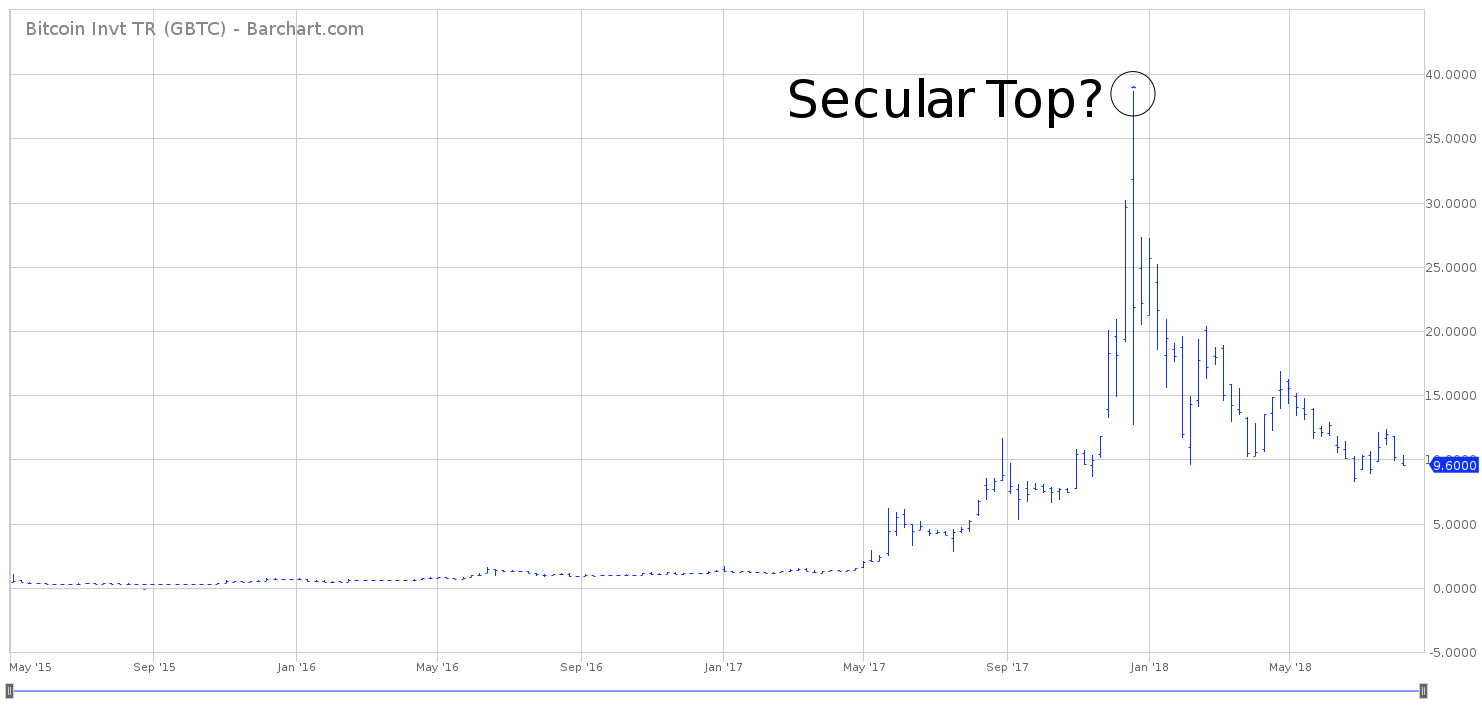

Major Support Level 2.01 Major Resistance Level 27.34

Minor Buy Signal 16.24 Minor Sell Signal 7.71

Major Buy Signal 28.01 Major Sell Signal 1.31

BRIEF OVERVIEW – Bitcoin Investment Trust GBTC

Bitcoin has come a long way in a short period of time. From its humble beginnings on

3 January 2009, the digital currency has quickly become one of the most popular speculative trading vehicles within the investment community. Despite bitcoin’s meteoric rise during the past few years, there exists a heated debate concerning the future direction of the digital currency. Does bitcoin (and its accompanying blockchain technology) have the ability to completely alter the global economy? Or is bitcoin simply a “flash in the pan,” on its way to being relegated to the dustbin of history? Let’s examine the details in order to gain a clearer perspective concerning the future direction of this digital currency.

For the first few years of its existence, bitcoin operated in complete obscurity. The only people who paid attention to bitcoin were a few “die-hards” in the cryptocurrency community. The overwhelming majority of traders and investors were not even aware of bitcoin’s existence. The tide began to turn in 2013, as the financial media released a series of reports and news stories discussing the digital currency’s meteoric rise from $13 to $266 during the first four months of the year. Six months later, bitcoin turned into a complete mania when the price exceeded $1,000. For a few days in November 2013, bitcoin actually exceeded the price of gold.

Since 2013, bitcoin has been a major player within the financial community. The debate rages on concerning the digital currency’s role as a legitimate financial asset. Most likely, this debate will continue for the next several years.

In an effort to provide investors with exposure to bitcoin, Grayscale Investments LLC introduced the Bitcoin Investment Trust. This Grayscale product is not an exchange traded fund (ETF). Instead, the trust is considered a private investment vehicle, not registered with the Securities and Exchange Commission (SEC) under the Investment Company Act of 1940. Despite its unique registration status, shares of the Bitcoin Investment Trust are freely traded on the OTC market. The product was launched on 4 May 2015, using the ticker symbol GBTC. The first trade occurred @ .4615 per share (less than 50 cents per share).

SHORT-TERM VIEW – Bitcoin Investment Trust GBTC

The short-term view is heavily in favor of the bearish camp. Essentially, GBTC has been drifting lower since December 2017. There have been a few rallies along the way. However, each rally has been met with heavy selling pressure. The next level of support is 8.24, followed by 7.71.

The bulls have been struggling to recapture the short-term momentum for the past eight months. At least for now, the most likely scenario is a continuation of lower prices. A weekly close above 15.20 will swing the momentum in favor of the bulls (highly unlikely any time in the near future).

LONG-TERM VIEW – Bitcoin Investment Trust GBTC

There’s no denying the fact that bitcoin has enjoyed tremendous growth during its relatively short existence. In percentage terms, no other asset class in the history of the financial markets has even come close to matching bitcoin’s meteoric rise. However, despite the incredible success of bitcoin (from an investment perspective), there still exists a large group of “cryptocurrency detractors” who claim bitcoin is a complete fraud. They believe the entire digital currency universe is ultimately headed to zero. Of course, there are an equal number of bitcoin enthusiasts who are convinced that cryptocurrencies will completely disrupt the entire global economy. Which group is correct? Is bitcoin on the verge of collapsing or will the digital currency universe dramatically alter the way consumers work, travel, communicate shop, eat and educate themselves? Let’s review the facts.

Ever since the United States was founded on 4 July 1776, our nation’s economy has experienced several disruptive and revolutionary changes. Based on historical evidence, each one of these generational changes have improved the lives and economic well-being of the people who lived through these time periods. Examples would include the Industrial Revolution, Technological Revolution, Digital Revolution and the Information Age.

Even though these historical events improved the lives of most citizens, there still existed a large number of people who (at the time) remained rather skeptical of the changes occurring within the domestic economy. There were many people filled with “doom and gloom” who thought their daily lives would be negatively impacted by the changes taking place at the time. Of course, it’s not uncommon for people to be filled with anxiety as their daily lives are being disrupted. Why? Because most people are resistant to change. Generally speaking, people do not like their lives being altered (even if the transformation improves their financial position in life).

In regard to bitcoin, the majority of the negativity emanating from bitcoin is based on people’s anxiety, as bitcoin clearly contains a great deal of disruptive potential; the type of disruption that could dramatically change our daily lives. Very similar to the Industrial Revolution of the early 19th century, people will continue to have a healthy skepticism of bitcoin until they are convinced that digital currencies will actually improve their lives, particularly from a financial perspective.

At this point in its life cycle, the likelihood of bitcoin collapsing into obscurity is rather remote. In fact, the entire digital currency universe (along with the accompanying blockchain technology) will most likely continue to be a growing presence throughout the global economy.

Going forward, the true disruptive force actually belongs to blockchain technology, which includes the blockchain’s ability to create smart contracts. Many people are under the impression that bitcoin holds the key to altering our daily lives. This is not true. Actually, bitcoin is nothing more than a currency which offers a P2P payment system on the blockchain. Bitcoin could completely disappear, yet the disruptive potential could still be intact thanks to the blockchain.

Over the course of the next two decades, it’s probably a safe bet that bitcoin and blockchain technology will remain fully functional within the global economy. One hundred years from now, the digital currency movement from the early 21st century will go down in the history books as one of the truly disruptive forces in our nation’s economy.

In regard to GBTC, the long-term view is bullish, despite the brutal decline during the past eight months. In order to upset the long-term bullish view, the bears would need to generate a weekly close below 2.01 (highly unlikely). The most likely scenario for GBTC is an extended trading range for the next several months.

SHORT-TERM CHART – Bitcoin Investment Trust GBTC

Please review the 6-month chart of GBTC. The bears are in complete control of the short-term trend. The next support level is 8.24, followed by 7.71. In order to generate a short-term bullish breakout, GBTC must produce a weekly close above 15.20. At first glance, it seems rather unlikely that 15.20 will be exceeded any time in the near future. However, GBTC has a tendency to produce dramatic price movements. Therefore, the trend could change very quickly.

LONG-TERM CHART – Bitcoin Investment Trust GBTC

Please review the 3-year chart of GBTC, which includes the entire trading history. Given the fact that GBTC has only been in existence for three years, it’s rather difficult to determine a long-term trading pattern. However, the most likely scenario is that GBTC formed an important top on 19 December 2017, @ 38.71. Was this a long-term secular top? Based on the current chart pattern, the answer is “No.” Instead, the most likely scenario is that GBTC generated an intermediate-term top @ 38.71. If this interpretation is correct, a new all-time high will be achieved within the next 18 to 24 months.