Consumer Staples Select Sector SPDR Fund ETF (XLP)

Key Statistics – XLP Consumer Staples Select ETF

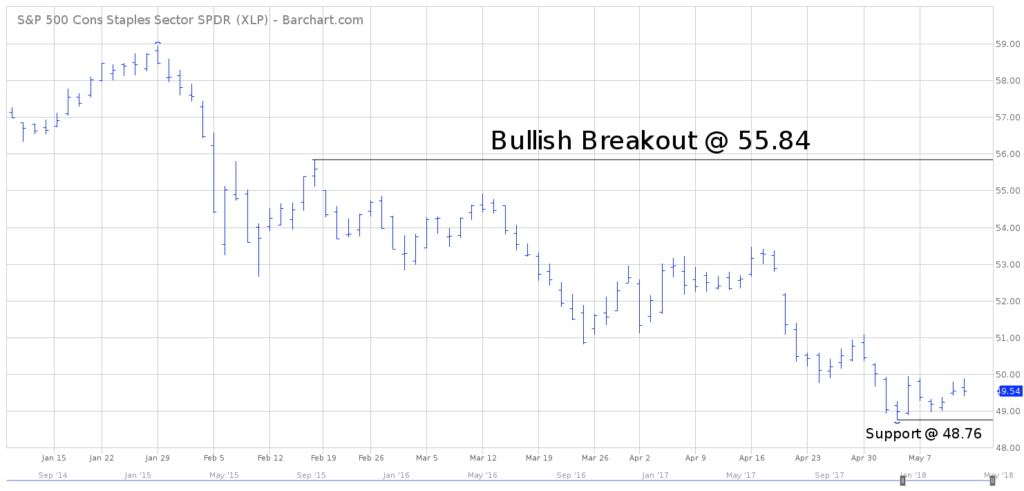

Minor Support Level 48.76 Minor Resistance Level 55.84

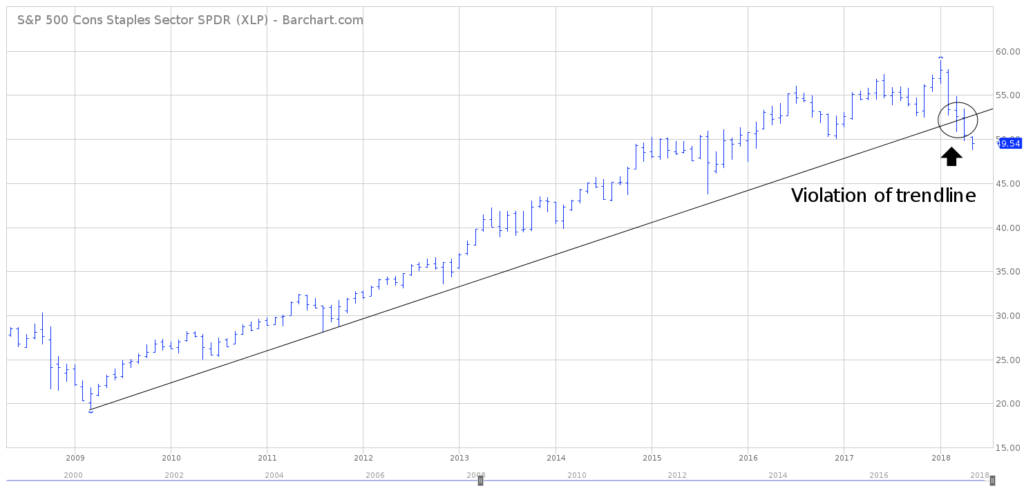

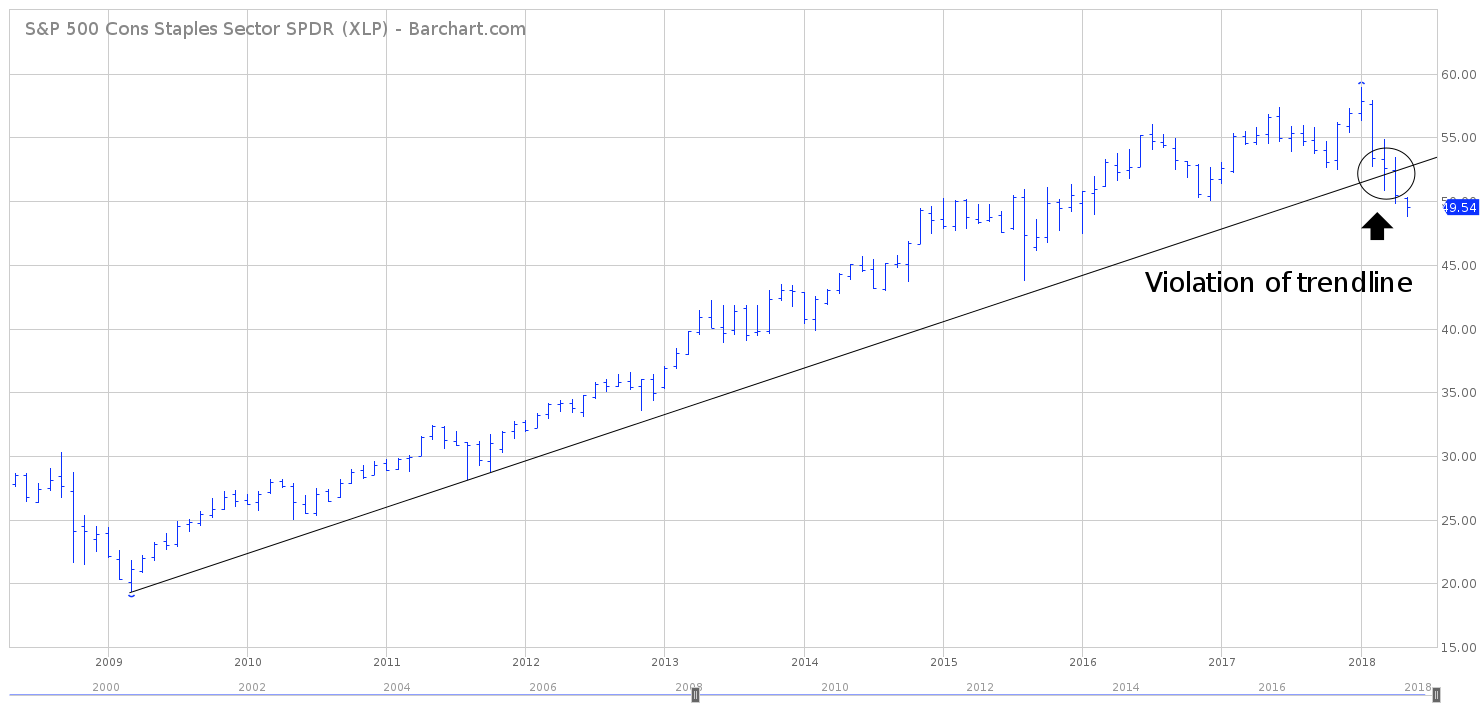

Major Support Level 24.95 Major Resistance Level 58.95

Minor Buy Signal 56.57 Minor Sell Signal 47.39

Major Buy Signal 63.53 Major Sell Signal 17.82

BRIEF OVERVIEW – XLP ETF

What are consumer staples and why are they such an important part of our nation’s economy? Consumer staples are essential products that we use in our daily lives. This would include such things as food, beverages, tobacco and household items. Consumer staples are items that people are unable or unwilling to cut out of their budgets, regardless of their financial situation. There is a constant demand for these products, no matter how well the economy is performing. As a result, consumer staples are considered to be non-cyclical in nature.

Consumer spending comprises 70% of our nation’s gross domestic product (GDP). This explains why consumer staples play such a vital role in the US economy. In many regards, consumer staples are the “bread and butter” of the economy because there is a never-ending demand for these products.

In terms of investments, the consumer staples industry is a very attractive vehicle for investors who prefer steady growth, reliable dividends and low volatility. The industry is dominated by a hand full of large multi-national corporations. It is an extremely competitive industry with high barriers to entry. Therefore, only the largest companies are able to survive. Companies involved in the selling of consumer staples include such names as Procter & Gamble, Philip Morris, Kimberly-Clark, Campbell Soup and Colgate-Palmolive.

Companies who succeed in the consumer staples industry are able to take advantage of economies of scale. This is the driving force that separates the winners from the losers in this hypercompetitive industry. Economies of scale refer to the reduced cost per unit that occurs from increased total output of a product.

In order to provide an example, let’s assume XYZ Widget Company produces 10,000 widgets per day @ $1.50 per widget. If the company expands its production to 20,000 widgets per day, the cost declines to $1.30 per widget. XYZ Widget Company has a certain amount of “fixed costs” which must be paid on a daily basis, regardless of how many widgets are manufactured. If the company increases its daily output, the cost per unit declines. This is an example of economies of scale.

In addition to economies of scale, consumer staples companies must be able to successfully differentiate their products from other competitors. For instance, on the surface, a bar of soap is a fairly boring product. Therefore, a successful company (like Procter & Gamble) will utilize its marketing skills and advertising budget to distinguish its brand of soap from other soap manufacturers. Product differentiation is a critically important component of a profitable consumer staples business.

As you can see, companies who participate in the consumer staples industry must have the ability to operate their business like a well-oiled machine. They must remain laser focused at all times. Due to the fact that profit margins are so thin, there is very little room for error. Those companies who are able to operate successfully, have the potential to realize enormous profits for their investors.

The SPDR family of exchange traded funds (underwritten by State Street Global Advisors) introduced the Consumer Staples Select Sector Fund ETF on December 16, 1998. The ticker symbol is XLP. This ETF is a perfect vehicle for investors who are searching for exposure to companies involved in consumer items such as beverages, food, tobacco, household products and personal products. XLP has 33 different holdings. The top five holdings include Procter & Gamble, Coca-Cola, PepsiCo, Philip Morris and Wal-Mart.

SHORT-TERM VIEW – XLP ETF

XLP has suffered a brutal decline during the past three months. The ETF has lost 16% of its value since January 29th. Obviously, the bears are in complete control of the short-term momentum. The next level of support is 48.76, which would represent XLP’s lowest price since January 2016.

Prior to January 29th, the momentum was in favor of the bullish camp for several months. The bulls have been struggling to recapture the momentum. It would take a weekly close above 55.84 to push XLP into the bullish camp.

LONG-TERM VIEW – XLP ETF

As we briefly discussed, consumer staples is an incredibly competitive industry. The survival rate of companies who operate in this space is very low. Only the “best of the best” are able to remain relevant on a consistent basis. The majority of these companies eventually fall to the wayside. The few companies who are able to survive, offer tremendous long-term profit potential for their investors.

Please review the following table.

Standard & Poor’s 500

Major Market Sectors

Consumer Discretionary Consumer Staples Energy

Financials Healthcare Information Technology

Industrials Materials Real Estate

Telecommunications Utilities

The Standard & Poor’s 500 stock index contains 11 different sectors. Consumer staples is one of the major sectors.

Since 1962, consumer staples is the second highest performing sector in terms of financial performance. During the past ten years, consumer staples have outperformed the S&P 500 (9.51% vs 8.79%). As an added bonus, the sector has performed incredibly well during the past three recessionary periods, easily beating the results of the S&P 500.

Due to their low volatility, consumer staples stocks are in high demand for those investors who prefer a defensive investment strategy. These companies generate consistent revenues based on the fact that there is a constant demand for its products. This explains why the consumer staples sector performs well during recessions.

In addition to being recession proof, the consumer staples sector rewards investors with above average dividend yields. Because of their slow and steady nature, consumer staples stocks have the ability to pay dividends even during recessionary periods. In fact, many of companies actually increase their dividends as the economy is slowing down. Since 1996, the annual dividend rate increase for consumer staples stocks is 8%, well above all other sectors in the S&P 500.

Portfolio diversification is another reason why investors are drawn to the consumer staples sector. These stocks typically have a very low correlation to the overall stock market. Historically, the correlation between the consumer staples sector and the S&P 500 is .64. For example, if the S&P 500 index increases 1.0%, consumer staples stocks will increase 0.64%. Because of the relatively low correlation to the S&P index, investors use consumer staples as a means to modify their portfolios.

Over the years, investors have attempted portfolio diversification using several different asset classes. Examples include government bonds, corporate bonds, real estate, international stocks, precious metals and commodities. Generally speaking, these assets have worked fairly well in diversifying a portfolio. Unfortunately, many investors discovered during the Financial Crisis of 2008, that most of these assets did a horrible job of providing diversification. In terms of diversification and low correlation, consumer staples actually provided the best performance during the financial crisis.

Without question, the consumer staples sector has generated tremendous performance results during the past several decades. It continues to produce consistent returns for its investors. However, all major market sectors each have their own internal problems that must be conquered in order to achieve financial success. The consumer staples sector is no exception to this rule. The one major concern for this sector is rising commodity prices. In fact, rising commodity prices is the “Achilles heel” of consumer staples companies.

Companies involved in the consumer staples space operate with an extremely thin profit margin. There simply is very little room to raise prices. Consequently, the leaders in the consumer staples industry are constantly searching for ways to reduce their costs. Unfortunately, rising commodity prices are very difficult to control. This explains why consumer staples companies been struggling during the past 12 months. These stocks have been declining because investors are facing the realization that commodities could be in the early stages of a new long-term bull market.

Despite the recent weakness of XLP, the long-term view remains extremely bullish. With the exception of the past four months, XLP has been moving relentlessly higher for the past nine years. However, it certainly appears that an important top may have been formed in January @ 58.95. Of course, it’s much too early to claim the bull market is finished. It would require a weekly close below 24.95 to reverse the long-term bullish momentum.

SHORT-TERM CHART – XLP ETF

Please review the 4-month chart of XLP. The bulls have surrendered the short-term trend. The chart pattern has turned decidedly bearish. The next level of support is 47.39. In order to turn the trend in favor of the bulls, XLP must produce a weekly close above 55.84.

LONG-TERM CHART – XLP ETF

Please review the 10-year chart of XLP. The long-term trend is clearly in favor of the bulls. However, an argument could be made that a major top was formed on January 29th @ 58.95. Admittedly, it is rather disturbing that the 9-year uptrend line was violated in March. However, as long as the overall stock market remains bullish, XLP should be given the benefit of the doubt.