VanEck Vectors Steel Exchange Traded Fund (SLX)

Key Statistics – VanEck Steel ETF SLX

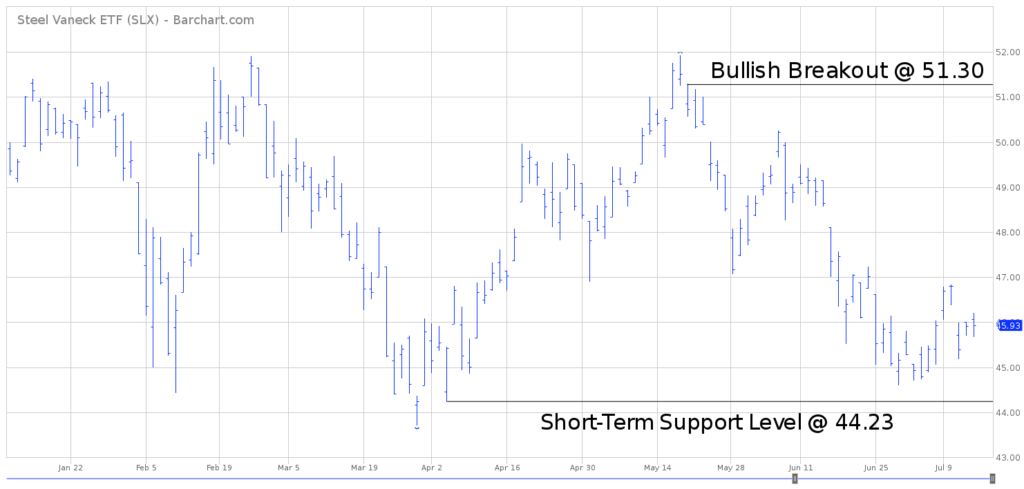

Minor Support Level 44.23 Minor Resistance Level 51.30

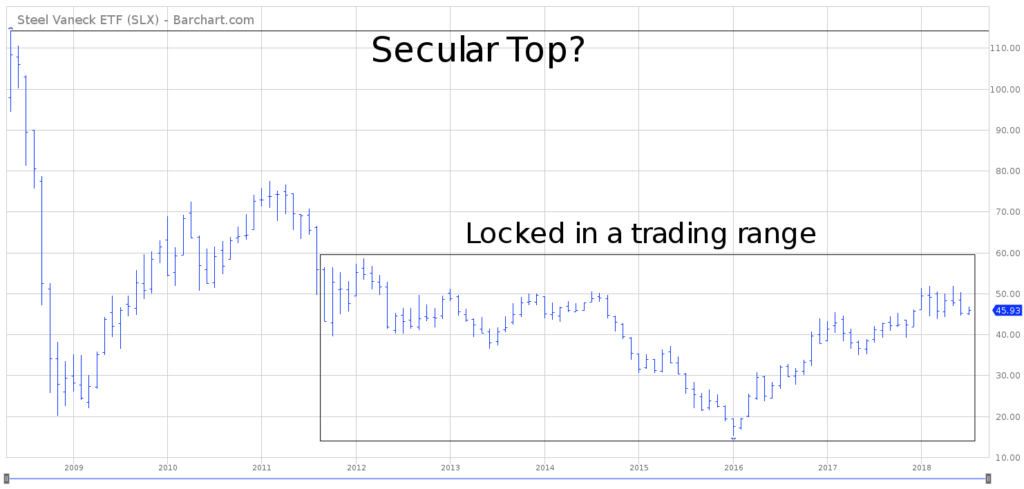

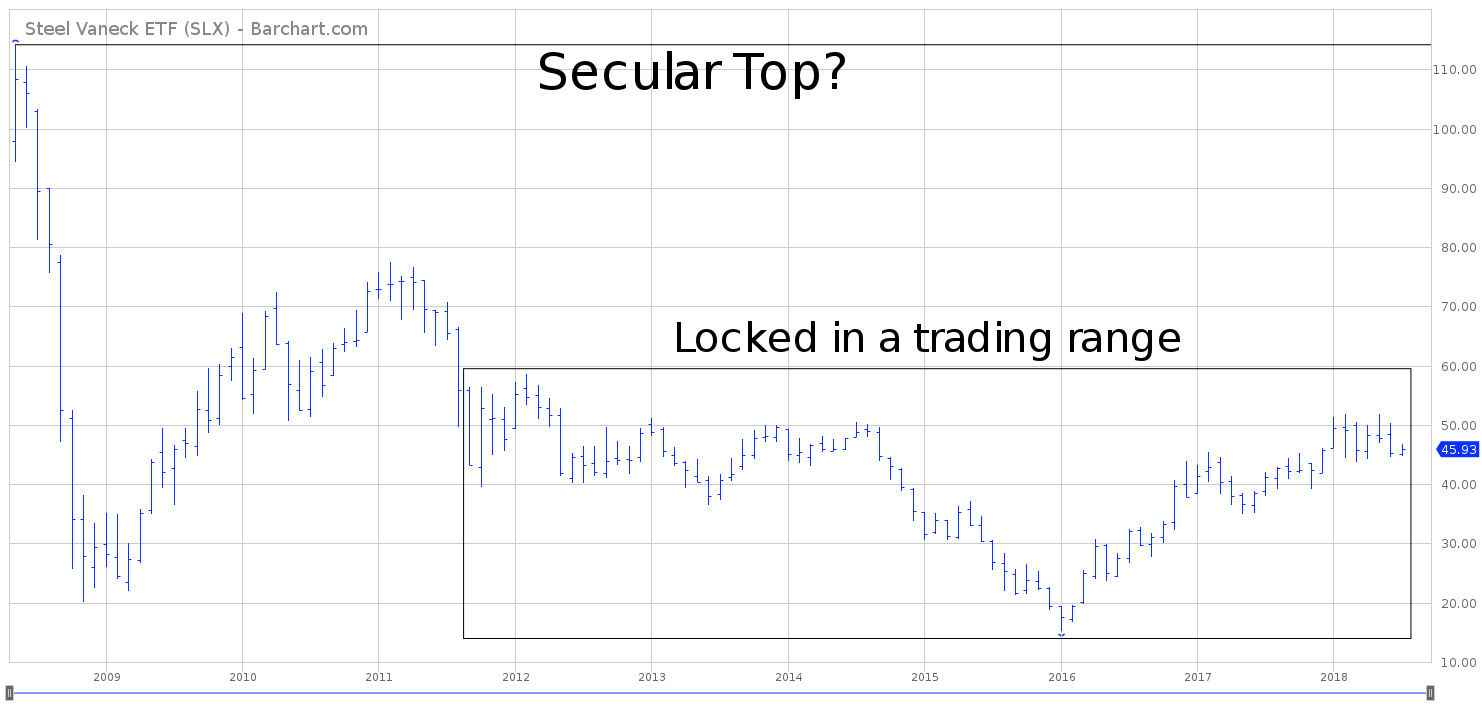

Major Support Level 16.70 Major Resistance Level 89.89

Minor Buy Signal 51.92 Minor Sell Signal 43.71

Major Buy Signal 93.34 Major Sell Signal 15.30

BRIEF OVERVIEW – VanEck Steel ETF SLX

Throughout its 242-year history, the United States has produced a large number of financial titans, many of whom rose to prominence during the Technological Revolution, also known as the Second Industrial Revolution (1870 – 1914). Arguably, the two greatest business leaders to emerge from this time period were Andrew Carnegie and John Pierpont (JP) Morgan. What did these two men have in common? They both amassed their fortune in the steel industry.

Carnegie entered the steel business in 1874, by forming Edgar Thomson Steel Works in his hometown of Pittsburgh, PA. Over the course of the next two decades, Carnegie dramatically expanded his steel operation. On July 1, 1892, he founded Carnegie Steel Company. In response to the unquenchable demand for steel throughout the 1890s and early-1900s, Carnegie’s empire exploded, quickly making Carnegie one of the wealthiest men in the country.

Carnegie’s steel empire attracted the attention of JP Morgan, who was in the process of building his own financial empire. In early-1901, Morgan made Carnegie an offer he couldn’t refuse. Morgan agreed to buy Carnegie Steel Company for $480 million ($14.1 billion in today’s dollars). The deal was (by far) the largest financial transaction in the history of the United States. The sale of Carnegie Steel Company officially took place on March 2, 1901, making Andrew Carnegie the wealthiest man in the world (even surpassing the net worth of oil tycoon, John D Rockefeller).

Morgan wasted no time in expanding his newly acquired steel operation. He officially changed the name to United States Steel Corporation. The company reached its zenith in 1911, producing almost 70% of all steel in the United States. Thanks to its total domination of the steel industry, US Steel became the world’s first billion dollar company (in terms of market capitalization).

The non-stop demand for steel finally began to subside following the end of World War I in 1918. The industry suffered another blow in the late 1920s, with the start of the Great Depression. Over the course of the next 30 years (1930 – 1960), the steel industry was rather stagnant. There was very little organic growth. Consequently, steel companies were reluctant to invest in new plant, equipment and technology. Other countries began to produce steel in a much more efficient capacity. The US steel companies began to slowly lose market share. The industry has never been able to return to the “good old days” when the United States was the global leader in steel production.

In terms of investments, the VanEck family of exchange traded funds launched the Vectors Steel ETF on October 10, 2006. The ticker symbol is SLX. This ETF is designed to track the performance of global companies involved in the steel industry. SLX has 28 different holdings. The top five holdings include Rio Tinto Plc, Vale S.A., Ternium S.A. and Vedanta Ltd.

SHORT-TERM VIEW – VanEck Steel ETF SLX

SLX has been drifting lower during the past eight weeks. The short-term momentum is in favor of the bears. The next level of support is 44.23. The bulls need a weekly close above 51.30 in order to recapture the momentum. At least for now, the path of least resistance is to the downside.

LONG-TERM VIEW – VanEck Steel ETF SLX

The US steel industry is a textbook example of what can happen to an industry when it loses its focus and refuses to modernize. Market share slowly evaporates and the industry loses its competitive edge. Businesses become complacent as they rest on their laurels, believing that they will always have a competitive advantage.

Throughout the late 19th century and well into the 20th century, the steel industry in the United States was the envy of the industrialized world. Other nations turned to the United States for the latest technological innovations and modernization techniques.

In terms of employment, the steel industry reached its peak in 1953, with 544,000 full-time hourly production workers. Total steelmaking capacity peaked in 1965, at 168 million tons for the year. During the past 50 years, the industry has never come close to reaching these levels (for both employment and steelmaking capacity).

Beginning in the mid-1950s, the United States slowly began losing market share to Japan. For the next 20 years (1955 to 1975), both countries moved in the opposite direction in regard to capital investment in the steel industry. The US made very little effort to modernize their plants. The majority of the capital investment was used to repair antiquated steel plants in lieu of investing in new equipment. In contrast to the United States, Japan built entirely new “greenfield” plants, taking advantage of modern technology and economies of scale.

Japan’s capital investments paid huge dividends, as the country’s production capacity increased 979% from 1957 to 1976. During the same time period, US production capacity increased a meager 34%. Japan slowly became the leader of the steel industry in regard to steel production and economies of scale. Other countries followed Japan’s lead throughout the 1960s and 1970s (particularly China and India), while the US continued to lose market share.

Over the years, many industry analysts have blamed the labor unions for ruining America’s steel industry. They claim labor unions forced steel companies to increase wages and employee compensation packages during the recession of the early-1970s. According to the analysts, this was the proverbial “straw that broke the camel’s back” for the US steel industry.

There is no denying the fact that increasing employee wages in the middle of a recession was certainly detrimental to the steel industry in America’s heartland. However, the steel industry was struggling well before the recession of the early-1970s.

Fast forward to today, and we find United States steel production well below its peak from the 1950s and 1960s. As of 2017, China accounted for 50% of total global steel production, while the US produced 6%. Despite the dramatic decline in market share during the past half century, the United States steel industry is in much better shape today versus 30 to 40 years ago. Although US steel production will never return to the “glory days” of the mid-20th century, the industry has enjoyed tremendous progress in terms of modernization and economies of scale. The industry is more profitable today than any time during the past 10 years.

Regarding the long-term view of SLX, the bears have the upper hand. SLX suffered a brutal decline following the Financial Crisis of 2008. The ETF has never fully recovered from the crisis. However, it does appear that an important bottom was formed in January 2016. In order to recapture the bullish momentum, SLX must generate a weekly close above 89.89.

SHORT-TERM CHART – VanEck Steel ETF SLX

Please review the 6-month chart of SLX. The short-term chart pattern is bearish. The next support level is 44.23. The chart pattern will turn bullish on a weekly close above 51.30.

LONG-TERM CHART – VanEck Steel ETF SLX

Please review the 10-year chart of SLX. The long-term chart pattern is bearish. Most likely, SLX formed a secular top in May 2008 @ 114.12. Based on the current chart formation, the ETF could easily remain locked in a trading range for the next 5 to 7 years. The range would be 15.30 to 58.54. A weekly close above 89.89 is required to push the long-term trend in favor of the bulls (highly unlikely).