Amplify Transformational Data Sharing ETF (BLOK)

Key Statistics

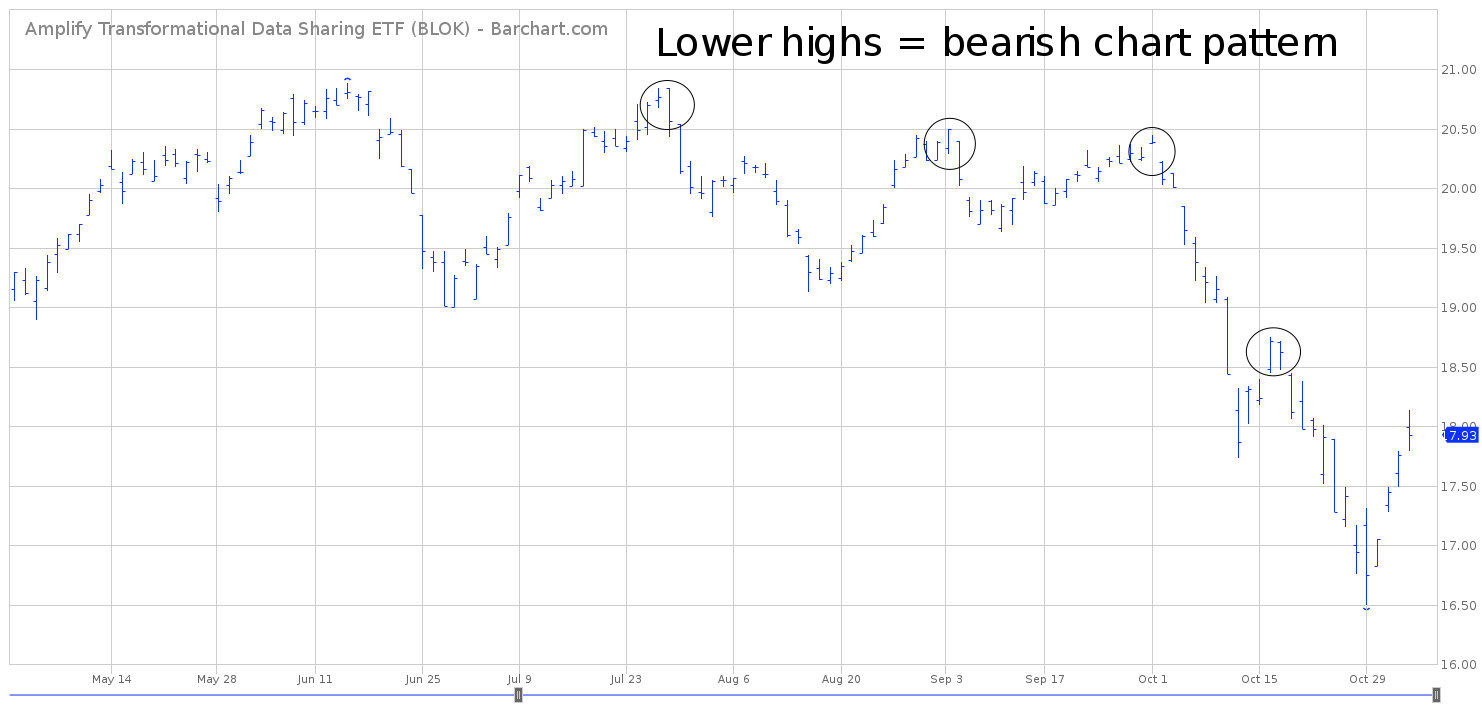

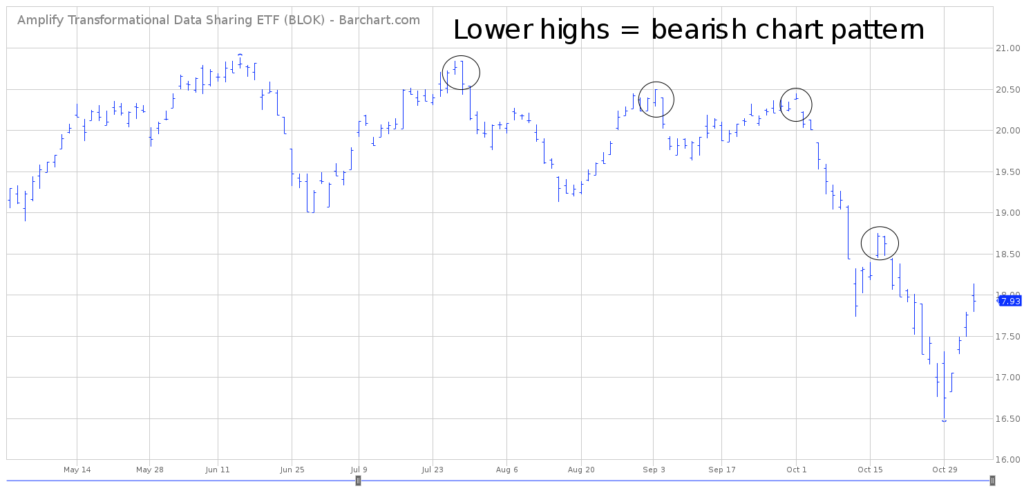

Minor Support Level 17.15 Minor Resistance Level 20.45

Major Support Level N/A Major Resistance Level N/A

Minor Buy Signal 21.46 Minor Sell Signal 16.50

Major Buy Signal N/A Major Sell Signal N/A

BRIEF OVERVIEW – BLOK

From an investment perspective, history has taught us that investing in the latest “buzzword” usually ends rather poorly for all parties involved. This includes the investors as well as the companies attempting to start the business. A few examples of buzzwords during the past decade include business-to-business (B2B), business-to-consumer (B2C), the new economy, cloud computing, internet of things and information superhighway. This list is just a small sample of the popular investment themes which have been available throughout the past few decades.

Based on historical results, investing in “themes” is usually a poor decision. Why? Because too many investors are chasing the same small group of stocks at the same time, which causes the stocks to become overvalued very quickly. Additionally, “buzzword companies” never live up to the hype created by the media. Consequently, quarterly earnings are a disappointment and investors quickly exit the stock.

Of course, there are always exceptions to every rule. A few of these buzzword companies actually survive and spawn an entire group of young companies which eventually create a dynamic new industry. It certainly appears that companies involved in blockchain technology could actually live up to the hype by creating a profitable experience for the investing community.

What exactly is blockchain technology and why will it succeed when most other buzzword industries disappoint their investors? Let’s examine the details.

In its simplest form, blockchain is a digital decentralized ledger that keeps a record of all transactions that take place across a peer-to-peer network. The major innovation is the fact that the technology allows market participants to transfer assets across the internet without the need for a centralized third party. In other words, blockchain technology removes the middleman from all transactions. That is the “pure beauty” of blockchain; it eliminates the need of the middleman (or third party).

Many newcomers to the digital currency revolution are under the impression that Bitcoin was created by Satoshi Nakamoto in January 2009. On the surface, this is a true statement. However, in actuality, Nakamoto created the blockchain technology along with Bitcoin. The blockchain that supports Bitcoin was developed specifically for the digital currency. This explains why it took people so long to realize that the technology could be used in other areas.

In order to be used for business purposes, the Blockchain had to be modified. For example, Bitcoin users love the idea of anonymity. However, several businesses have rules and regulations which require them to verify the identity of their clients. The KYC (know your customer) rule and AML (anti-money laundering) policy must be implemented for all firms operating in the financial services industry. Therefore, the Bitcoin Blockchain was not a practical solution for this particular industry.

In addition to identity verification, many firms require client privacy. Large institutional banks in China have used the Blockchain to develop an asset custody system. This system allows only the interested parties to view a specific transaction. This particular Blockchain is completely different than the Bitcoin Blockchain, which allows anyone to look at the Bitcoin ledger and view all transactions.

Several firms are experimenting with a token-free shared ledger, which is essentially a Blockchain without a digital currency. This type of Blockchain would work well for companies who simply want to track their inventory. Examples would include businesses involved in the auto industry, food industry and medical supplies industry.

As you can see, the Blockchain can be implemented in several other areas apart from Bitcoin. This technology has the ability to be a disruptive force to many industries across the global economy.

In regard to investments, the Amplify family of ETFs created one of the world’s first Blockchain ETFs. The ticker symbol is BLOK, with a launch date of 17 January 2018. According to the prospectus, 80% of ETF assets are invested in equity securities of companies actively involved in the development of blockchain technology. The top five holdings include Digital Garage, Taiwan Semiconductor Manufacturing Co Ltd ADR, Overstock.com, SBI Holdings Inc and Red Hat Inc.

SHORT-TERM VIEW – BLOK

Due to the recent decline in the overall stock market, the short-term momentum traders have pushed BLOK into bearish territory. The next level of support is 17.15. In order to recapture the upside momentum, the bulls need a weekly close above 20.45. As long as the major stock indices are pushing their way lower, BLOK will remain in bearish territory.

LONG-TERM VIEW – BLOK

“Blockchain will do for our money system what the internet did for information and what the internal combustion engine did for transportation.” – David Morris, 2015 TEDx event

What a profound statement! Will Mr Morris’ vision be proven correct? Will the Blockchain completely change our global fiat currency system? Of course, it’s much too early to know for sure. Blockchain technology is still in the early stages of its life cycle. To use a baseball analogy, we’re in the second inning of a nine inning baseball game.

For a moment, think back to the early days of the internet revolution. Consumers were constantly bombarded with commercials from AT&T, MCI and AOL about the “information superhighway.” However, 95% of consumers had no idea what these commercials were trying to portray. These commercials began to appear on a regular basis beginning in 1995. However, the internet did not become “mainstream” in American households until the early 2000s.

Today, blockchain technology is probably in the same spot as the internet found itself in the mid-1990s. In other words, it will take at least 5 to 7 more years before the Blockchain becomes fully entrenched in our global society.

Blockchain will impact a number of industries across our global economy. However, the industry that will undergo the greatest change will be the financial services industry. Why? Because Blockchain does an amazing job of removing financial intermediaries from the equation. A financial intermediary is a fancy word for a middleman.

In today’s financial landscape, the intermediary stands between the customer and the exchange. The most common intermediary is a broker. Blockchain technology will ultimately eliminate the role of the broker. Of course, the financial services industry will fight vigorously to prevent the Blockchain from infiltrating their “turf.” However, they will be fighting a losing battle. Whether we like it or not, blockchain technology is headed to an industry near you.

The world’s first commission-free trading exchange will open its doors for business in January 2019. The Digitex Futures Exchange will offer commission-free trading thanks to blockchain technology. In fact, there will be no fees or service charges of any kind. Additionally, customer funds will not be held with the exchange. Instead, each customer will maintain an account through an Ethereum smart contract. The Digitex Futures Exchange is a perfect example of how quickly blockchain technology is making its way to the financial services industry.

Financial services is certainly not the only industry that will be impacted by the Blockchain. Other industries include real estate, legal, retail, crowdfunding, supply chain management, education and healthcare. In fact, almost any industry that involves an intermediary or requires data storage will probably be affected by blockchain technology.

In regard to BLOK, the long-term trend has not been established because the ETF only has ten months of historical trading activity. However, based on the long-term growth prospects for the Blockchain, a strong argument can be made that BLOK has enormous upside potential over the course of the next decade. From a momentum perspective, a bullish entry level would be 20.45. Please note, this is not a long-term entry level. It’s simply the best available entry point based on the current data.

SHORT-TERM CHART – BLOK

Please review the attached 6-month chart of BLOK. Without question, this is a bearish chart pattern. The ETF has made a series of lower highs during the past four months. Additionally, BLOK recently generated a new all-time low. Of course, the ETF has only been trading for ten months. Therefore, we can’t judge BLOK too harshly because of its limited trading history.

LONG-TERM CHART

A long-term chart is not available due to the short trading history of BLOK. The current chart pattern will turn bullish on a weekly close above 20.45. As we discussed earlier, this is not a long-term entry level. It’s simply the best available entry point based on the current data.

2 Comments

Leave a Reply

You must be logged in to post a comment.

Good article – thanks for the info!

You’re welcome!